Functional-Based Reserving with the R Package ProfileLadder

Matúš Maciak, Rastislav Matúš, Ivan Mizera, and Michal Pešta

Source:vignettes/my_vignette.Rmd

my_vignette.RmdThe R package ProfileLadder provides

nonparametric, functional-based methods for claims reserving based on

aggregated chain-ladder data also known as the run-off

triangles. The package implements three estimation/prediction

algorithms (PARALLAX, REACT, and MACRAME) and the permutation bootstrap

add-on proposed in Maciak, Mizera, and Pešta (2022).

The package offers a flexible and computationally effective framework

for point-wise and distributional reserve predictions and includes

pertinent visualization and diagnostic tools through standard S3

methods—such as plot(), predict(),

print(), or summary(). It also provides

accessor functions and real-world datasets to support exploratory

analysis across insurance, operational risks, and other domains where

triangular data structures arise, making modern, transparent, and

extensible alternatives to classical approaches accessible in insurance

industry and academic research.

The following lines provide an illustrative sample analysis and

reserve prediction for two specific run-off triangles using all three

nonparametric prediction algorithms and other functions introduced

within the ProfileLadder package. The functionality of the

core functions of the package are and some important features are

presented and discussed. Further theoretical details can be found in

Maciak, M., Mizera, I., and Pešta, M. (2022). Functional Profile Techniques for Claims Reserving. ASTIN Bulletin, 52(2), 449 – 482. DOI: 10.1017/asb.2022.4

Package manual and GitHub pages

- PDF/HTML manual: https://CRAN.R-project.org/package=ProfileLadder

- GitHub Pages: https://42463863.github.io/ProfileLadder/index.html

The package ProfileLadder can be installed directly from

CRAN using a standard command

install.packages("ProfileLadder")The package ProfileLadder also allows for a convenient

and elegant integration with the leading actuarial R

package ChainLadder commonly utilized for risk assessment

and actuarial practice. This is mainly ensured through two functions

implemented in ProfileLadder,

as.profileLadder() and observed(). Therefore,

both these actuarial libraries (R packages) are used in

the following illustrations.

Package structure

The key functions of the ProfileLadder package that

implement three functional-based nonparametric (point) reserve

prediction algorithms and the overall (distributional) reserve

prediction in terms of the proposed permutation bootstrap resampling

are

-

parallelReserve()– for PARALLAX and REACT; -

mcReserve()– for the MACRAME algorithm; -

permuteReserve()– for the permutation bootstrap add-on.

Note some obvious (and practically convenient) similarities of the

notation and the implementation details that shared with the

R package ChainLadder. More details about

the package structure—all functions, S3 type methods, accessor

functions, and illustrative datasets can be found on GitHub

Pages.

Notation and example datasets

There are two real datasets—cumulative run-off triangles (both from

the package ProfileLadder)—used in the following claims

reserving example.

The cummulative run-off triagle is a specific data structure represented by a collection of random variables denoted as , where the rows are typically assumed to be independent among each other and they represent the origins of the reported claims. The columns, on the other hand, represent the development periods.

The incremental run-off triagle is an analogous dataset represented by a collection of random variables ’s, , where , for and , where, in addition, for completeness.

There are numerous (real-life) datasets (run-off triangles) not only

from the actuarial practice provided as an integral part of the

ProfileLadder package while most of them were not yet made

available in any other R package nor any other publicly

available source. Some of the datasets are unique in this aspect: For

instance, the dataset GFCIB, provided by the Guarantee Fund

of the Czech Insurers’ Bureau (GFCIB) and datasets

CZ.casco, CZ.liability, and

CZ.property provided by a major and market-leading

insurance company in the Czech Republic contain relatively large

(compared to other publicly available actuarial data) run-off triangles

(for example, GFCIP from the mandatory car insurance in the

Czech Republic contains

origins/quarters and

development periods—quarters again). Similarly, the datasets

CZ.casco, CZ.liability, and

CZ.property provide separate run-off triangles for gross

paid amounts and RBNS reserves (all with the dimensions

years).

A comprehensive overview of the data included in the

ProfileLadder package can be obtained in a standard way by

using the command

data(package = "ProfileLadder")Two particular run-off triangles are selected in the following illustrations:

a) Cameron Mutual Insurance Company Data

The dataset belongs to a larger database of real run-off triangles

(provided by Mayers and Shi, 2011) and available also (in a long format

structure) in the R package raw. The

run-off triangle is completed into a full square—meaning that “future”

payments are known (typically they are provided retrospectively, mainly

for some evaluation and back-testing purposes). `

help("CameronMutual") ## output omitted

(cameron <- CameronMutual)## dev

## origin 1 2 3 4 5 6 7 8 9 10

## 1 5244 9228 10823 11352 11791 12082 12120 12199 12215 12215

## 2 5984 9939 11725 12346 12746 12909 13034 13109 13113 13115

## 3 7452 12421 14171 14752 15066 15354 15637 15720 15744 15786

## 4 7115 11117 12488 13274 13662 13859 13872 13935 13973 13972

## 5 5753 8969 9917 10697 11135 11282 11255 11331 11332 11354

## 6 3937 6524 7989 8543 8757 8901 9013 9012 9046 9164

## 7 5127 8212 8976 9325 9718 9795 9833 9885 9816 9815

## 8 5046 8006 8984 9633 10102 10166 10261 10252 10252 10252

## 9 5129 8202 9185 9681 9951 10033 10133 10182 10182 10183

## 10 3689 6043 6789 7089 7164 7197 7253 7267 7266 7266b) Vehicles Damages within a Conventional Full Casco Insurance

The second dataset represents a standard run-off triangle as it is typically available for actuaries when performing the risk assessment task and predicting the point and distributional reserve. The dataset represents cumulative payments for claims related to the compulsory vehicle insurance in the Czech Republic (having 17 origin years and, similarly, 17 development perios—years again).

help("CZ.casco") ## output omitted

(casco <- CZ.casco$GrossPaid)## dev

## origin Dev1 Dev2 Dev3 Dev4 Dev5 Dev6 Dev7 Dev8 Dev9

## 1 532522 689585 688841 689149 689357 689775 689742 689851 689851

## 2 423582 522523 522135 522605 522643 522352 522352 522329 522314

## 3 373866 486702 487670 486499 486370 486335 486352 486352 486260

## 4 441769 561423 558395 557759 557882 558181 558096 557934 557847

## 5 503292 632003 630153 630124 629686 629598 630431 630378 630357

## 6 554625 699257 700824 700508 700930 700889 701568 701462 701452

## 7 613011 759145 759427 759916 758478 758380 758204 758097 758324

## 8 605922 754837 758541 760264 760850 761308 761178 761153 761108

## 9 555154 659550 662410 663053 667075 667300 669785 669770 670158

## 10 514900 622015 623098 624337 624632 624664 624664 626112 NA

## 11 581196 706328 708099 708853 708447 708194 708428 NA NA

## 12 613266 778185 780959 781436 781720 781561 NA NA NA

## 13 706120 885442 890414 891789 894514 NA NA NA NA

## 14 859707 1052701 1057512 1059593 NA NA NA NA NA

## 15 951189 1197280 1207771 NA NA NA NA NA NA

## 16 1061511 1317965 NA NA NA NA NA NA NA

## 17 1121591 NA NA NA NA NA NA NA NA

## dev

## origin Dev10 Dev11 Dev12 Dev13 Dev14 Dev15 Dev16 Dev17

## 1 689839 689813 689795 689767 689664 689613 689568 689497

## 2 522271 522267 522231 522196 522104 522072 522003 NA

## 3 486090 485992 485988 485984 485984 485984 NA NA

## 4 557781 557588 557198 557062 557049 NA NA NA

## 5 630338 630280 630270 630271 NA NA NA NA

## 6 701439 701433 701433 NA NA NA NA NA

## 7 758263 758233 NA NA NA NA NA NA

## 8 761068 NA NA NA NA NA NA NA

## 9 NA NA NA NA NA NA NA NA

## 10 NA NA NA NA NA NA NA NA

## 11 NA NA NA NA NA NA NA NA

## 12 NA NA NA NA NA NA NA NA

## 13 NA NA NA NA NA NA NA NA

## 14 NA NA NA NA NA NA NA NA

## 15 NA NA NA NA NA NA NA NA

## 16 NA NA NA NA NA NA NA NA

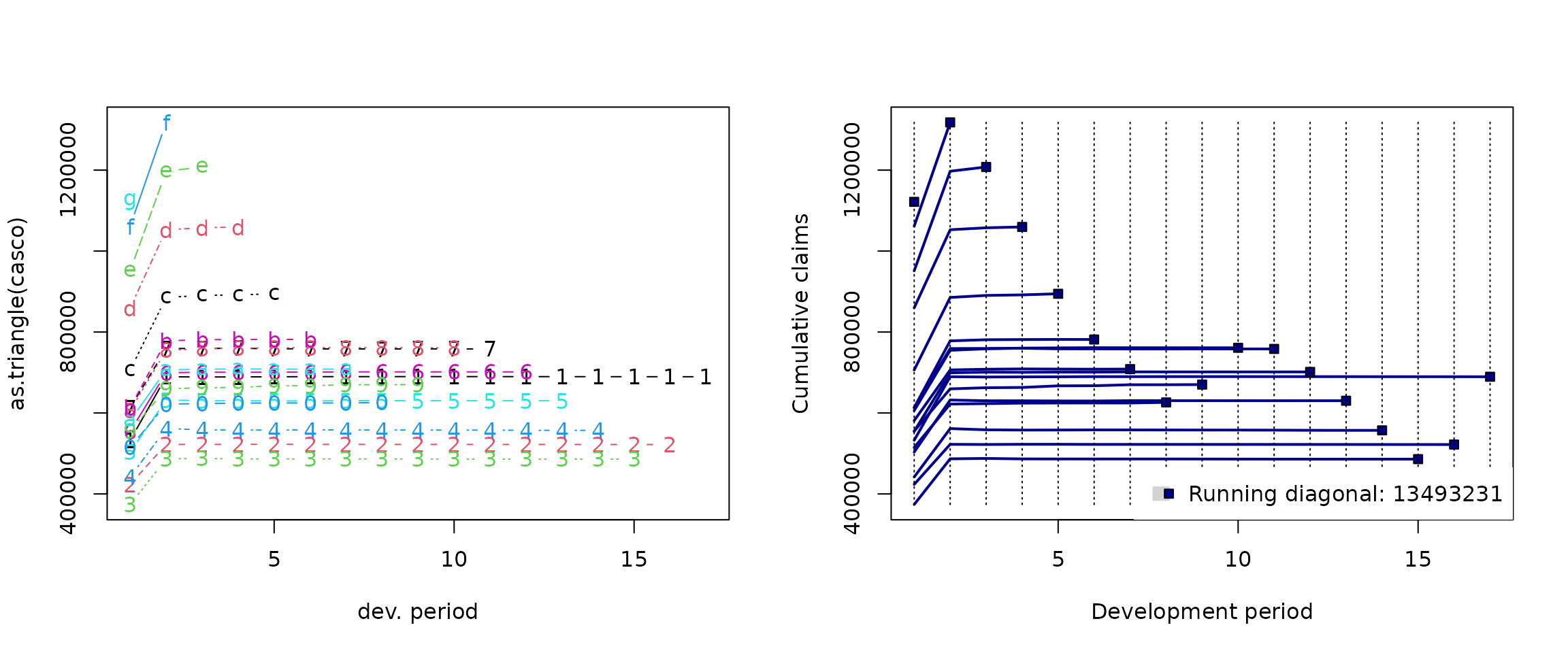

## 17 NA NA NA NA NA NA NA NA1. Data visualization with ProfileLadder

Run-off triangles can be either printed in terms of a

complete/incomplete matrix (as above) or the data can be visualized

using a standard plot() method; however, two different S3

classes for the underlying run-off triangle can be used—the run-off

triangle is either of the class triangle (the S3 class

provided by the actuarial package ChainLadder) or an

extented triangle class profileLadder, implemented in the

R package ProfileLadder, can be used as a

more complex alternative:

par(mfrow = c(1,2))

### S3 class 'triangle' from the ChainLadder pkg

plot(as.triangle(casco))

### S3 class 'profileLadder' from the ProfileLadder pkg

plot(as.profileLadder(casco))

The extended triangle class ProfileLadder (which can be

converted from the S3 classes triangle or

matrix by using the as.profileLadder()

function) allows, in addtion, for plotting the future (“unknown”)

profiles—if they are provided in the data for some comparisons,

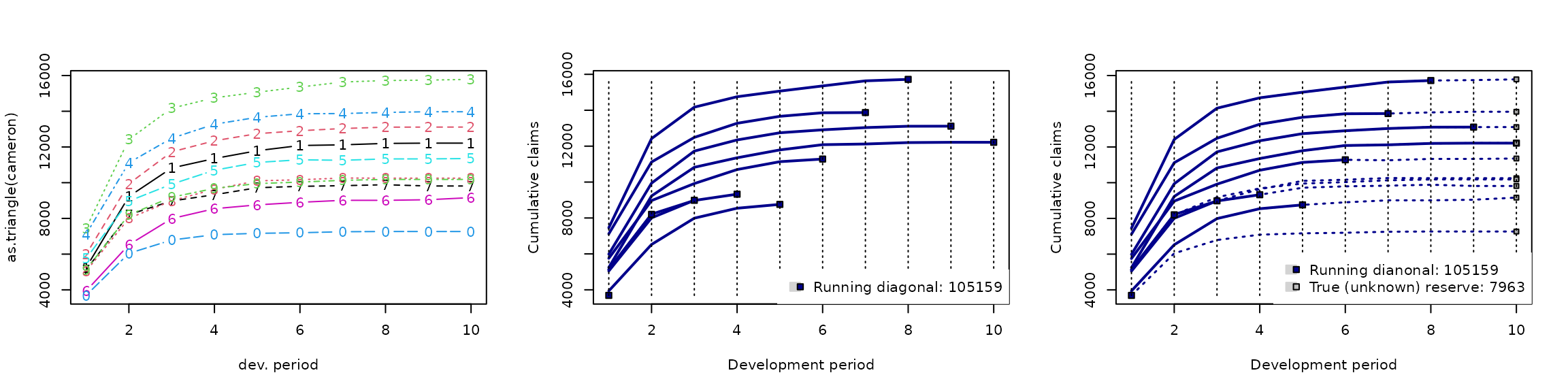

back-testing, or other evaluation purposes. This can be illustrated for

the Cameron Mutual insurance data (that contain such future

profiles):

par(mfrow = c(1,3))

### S3 class 'triangle' from the ChainLadder pkg

plot(as.triangle(cameron))

### S3 class 'profileLadder' from the ProfileLadder pkg

plot(as.profileLadder(observed(cameron)))

### S3 class 'profileLadder' (run-off triangle with future profiles)

plot(as.profileLadder(cameron))

Once the future profiles are provided in the data, the information

about the true reserve, typically denoted as

and defined as

is also reflected in the legend as

True (unknown) reserve (see the right panel in the figure

above). Otherwise, the task of an actuary is to predict the reserve as

where

for

represents the predicted ultimate payments (the last column of

the completed run-off triangle). The quantity

represents the amount of already paid claims (the sum of the last

running diagonal, values

,

for

).

Note: The utility function observed(),

used in the code above and implemented in the R package

ProfileLadder, allows an easy integration of the package

with the core actuarial library ChainLadder and,

particularly, the easily use the data from other R

package raw in both parametric and nonparametric reserving

techniques. More details can be found using the R help session

help("observed").

2. PARALLAX

The idea of the PARALLAX algorithm (PARALLel ApproXimation of missing fragments), is to impute the missing parts of the run-off triangle by the most similar segments—triangle rows that can be found among the already observed development profiles. The name reflects the fact that the imputation of missing segments in unobserved functional development profiles is always performed in a parallel way using the observed fragments.

To illustrate the principle, we use the Cameron Mutual data first. The run-off triangle provides also the “unknown” future outcomes (functional profile segments that are supposed to be predicted by the algorithm). However, typical information used in the actuarial practice (for claims reserving and reserve prediction) would be of the run-off triangle form as

observed(cameron)## dev

## origin 1 2 3 4 5 6 7 8 9 10

## 1 5244 9228 10823 11352 11791 12082 12120 12199 12215 12215

## 2 5984 9939 11725 12346 12746 12909 13034 13109 13113 NA

## 3 7452 12421 14171 14752 15066 15354 15637 15720 NA NA

## 4 7115 11117 12488 13274 13662 13859 13872 NA NA NA

## 5 5753 8969 9917 10697 11135 11282 NA NA NA NA

## 6 3937 6524 7989 8543 8757 NA NA NA NA NA

## 7 5127 8212 8976 9325 NA NA NA NA NA NA

## 8 5046 8006 8984 NA NA NA NA NA NA NA

## 9 5129 8202 NA NA NA NA NA NA NA NA

## 10 3689 NA NA NA NA NA NA NA NA NAA fancy print option is also implemented in the

ProfileLadder package to visually distinguish between the

data part that is typically available at the time of the reserve

prediction and the data that are provided ex-post for some evaluation

purposes. This can be set or altered (in the interactive environments

only) by

options(profileLadder.fancy = TRUE)

set.fancy.print() ## custom-defined colorsThe prediction of the future claims performed by the PARALLAX algorithm is obtained as

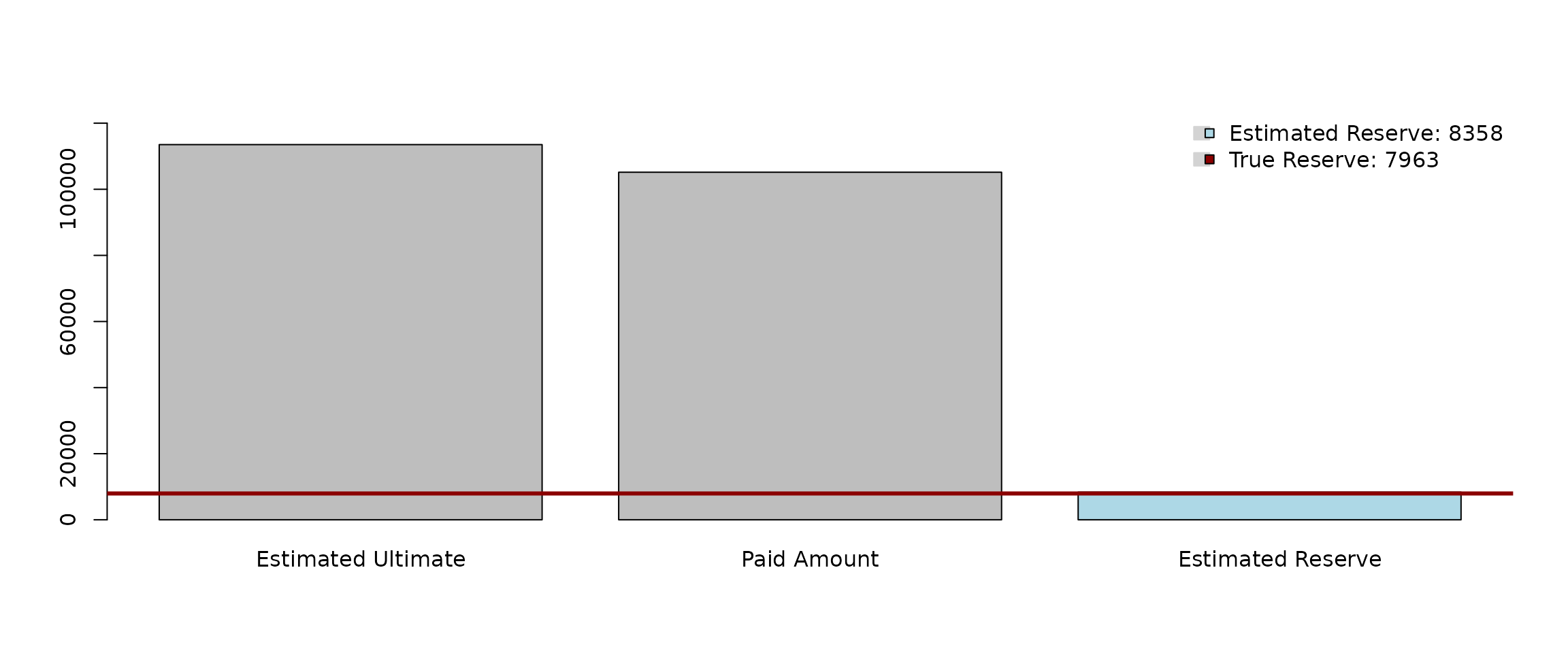

(parallax.cameron <- parallelReserve(cameron))## PARALLAX Reserving

## Estimated Reserve Estimated Ultimate Paid Amount

## 8540 113699 105159

## True Reserve

## 7963## PARALLAX method (functional profile completion)## 5244 9228 10823 11352 11791 12082 12120 12199 12215 12215

## 5984 9939 11725 12346 12746 12909 13034 13109 13113 13113

## 7452 12421 14171 14752 15066 15354 15637 15720 15724 15724

## 7115 11117 12488 13274 13662 13859 13872 13947 13951 13951

## 5753 8969 9917 10697 11135 11282 11320 11399 11415 11415

## 3937 6524 7989 8543 8757 8904 8942 9021 9037 9037

## 5127 8212 8976 9325 9539 9686 9724 9803 9819 9819

## 5046 8006 8984 9333 9547 9694 9732 9811 9827 9827

## 5129 8202 8966 9315 9529 9676 9714 9793 9809 9809

## 3689 6276 7741 8295 8509 8656 8694 8773 8789 8789 As far as the input data also contains “unknown” future developments,

the output above also provides the amount of the true reserve

(7963 – which is not printed otherwise). Standard summary

method can be applied to the output of the

parallelReserve() function – the S3 object of the class

ProfileLadder:

summary(parallax.cameron)## PARALLAX reserve prediction (by origins)

## First Latest Dev.To.Date Ultimate IBNR

## 2 5984 13113 1.0000000 13113 0

## 3 7452 15720 0.9997456 15724 4

## 4 7115 13872 0.9943373 13951 79

## 5 5753 11282 0.9883487 11415 133

## 6 3937 8757 0.9690163 9037 280

## 7 5127 9325 0.9496894 9819 494

## 8 5046 8984 0.9142159 9827 843

## 9 5129 8202 0.8361709 9809 1607

## 10 3689 3689 0.4197292 8789 5100

## total 49232 92944 0.9158488 101484 8540## Overall reserve summary## Est.Reserve Est.Ultimate Paid Amount True Reserve Reserve%

## 8540.00 113699.00 105159.00 7963.00 7.25The summary output above is analogous to the output provided by

parametric reserving methods implemented in ChainLadder.

For example, considering a typical benchmark over-dispersed Poisson

model (ODP) implemented in glmReserve() from the R package

ChainLadder, the following summary output is provided:

summary(glmReserve(observed(cameron)))## Latest Dev.To.Date Ultimate IBNR S.E CV

## 2 13113 1.0000000 13113 0 0.01035287 Inf

## 3 15720 0.9992372 15732 12 29.38975320 2.4491461

## 4 13872 0.9934116 13964 92 73.46098788 0.7984890

## 5 11282 0.9850694 11453 171 96.26787355 0.5629700

## 6 8757 0.9688019 9039 282 120.58781735 0.4276164

## 7 9325 0.9397360 9923 598 177.57019068 0.2969401

## 8 8984 0.8905630 10088 1104 246.00693847 0.2228324

## 9 8202 0.7789914 10529 2327 379.54811405 0.1631062

## 10 3689 0.4788422 7704 4015 622.22022041 0.1549739

## total 92944 0.9152986 101545 8601 880.66723938 0.1023913Due to obvious analogy between the outputs from the nonparametric

reserving method (‘parallelReserve()’) and the standard parametric

approach (glmReserve()) we omit further interpretation of

the whole output and we only focuss on differences.

Note: The outout from the summary()

method applied to the S3 class object profileLadder

produced by the parallelReserve() function from the R

package ProfileLadder shares the same layout as the summary

method applied to the classical parametric reserving methods from the

R package ChainLadder In the example

above, the summary() method is applied to the object of the

class glmReserve produced by glmReserve().

Note, that the First column is only given in the output

for the nonparametric reserving method (ProfileLadder

package) while the columns denoted as S.E and

CV are only available for the parametric approach

(ChainLadder package). This is due to the fact that the ODP

model is based on a specific distributional assumption and, therefore,

standard errors (S.E) and the coefficient of variation

(CV) can be both directly obtained. The nonparametric

PARALLAX algorithm is, however, model-free and, therefore, the point

prediction of the reserve is provided only (unless a bootstrap

resampling add-on is used – see Section 5).

On the other hand, the summary for PARALLAX gives important information about the origin stability – which is, in practice, very often accessed from the first run-off triangle column.

Some additional information is also provided in the second part of the output. In particular, beside the predicted reserve (Est.Reserve) and the predicted ultimates

(Est.Ultimate), there is also the sum of the running

diagonal provided (Paid Amount). In addition, if the

run-off triangle is accompanied with the true future outcomes, then the

true reserve and the prediction accuracy in terms of the ratio of the

predicted amount and the true value are both provided.

If the same reserving method is applied to the Casco insurance data

(i.e., incomple run-off triangle profiles) the summary output is very

similar but some values are missing in the outputs (NAs are

provided instead):

parallax.casco <- parallelReserve(casco)

summary(parallax.casco)## PARALLAX reserve prediction (by origins)

## First Latest Dev.To.Date Ultimate IBNR

## 2 423582 522003 1.0001360 521932 -71

## 3 373866 485984 1.0002882 485844 -140

## 4 441769 557049 1.0003089 556877 -172

## 5 503292 630271 1.0004286 630001 -270

## 6 554625 701433 1.0004250 701135 -298

## 7 613011 758233 1.0003932 757935 -298

## 8 605922 761068 1.0004312 760740 -328

## 9 555154 670158 1.0005285 669804 -354

## 10 514900 626112 1.0006025 625735 -377

## 11 581196 708428 1.0006116 707995 -433

## 12 613266 781561 1.0007273 780993 -568

## 13 706120 894514 1.0008134 893787 -727

## 14 859707 1059593 0.9981179 1061591 1998

## 15 951189 1207771 0.9966341 1211850 4079

## 16 1061511 1317965 0.9890660 1332535 14570

## 17 1121591 1121591 0.8053848 1392615 271024

## total 10480701 12803734 0.9780287 13091369 287635## Overall reserve summary## Est.Reserve Est.Ultimate Paid Amount True Reserve Reserve%

## 287635 13780866 13493231 NA NABeside the reserve prediction

(given in thousands CZK) there is also an information about the

estimated ultimate payments (the sum of the last column in the completed

run-off triangle), and the summary of the claims being already paid—

Paid Amount

(again in thousands CZK). Note that last two values in the output are

denoted as NA because the future outcomes are not available

for the given run-off triangle. Both predictions can be directly

visualized using the S3 method plot():

In general, the output of the parallelReserve() function

is a list of the S3 method class profileLadder with the

following elements:

$reserve– a numeric vector with four quantities:Paid Amountgives the overall claim payments being already settled by the insurance company – the sum of the last observed diagona, ;Estimated Ultimatestates for the predicted total amount of claim payment – the sum of the last column in the completed run-off triangle, ;Estimated Reservegives the point prediction of the reserve – defined as the difference ; Finally,True Reserveprovides the true value of the reserve if such information is available;$method– type of the prediction algorithm being used to complete the run-off triangle and to give the point prediction of the reserve (PARALLAX,REACT, orMACRAME);$Triangle– the input run-off triangle;$FullTriangle– the completed run-off triangle – a full square;$trueComplete– the true run-off triangle – if available.

3. REACT

The REACT algorithm (approximation by the most

REcent ACcidenT year)

is implemented within the same R function as the

PARALLAX algorithm—the parallelReserve() function with an

additional parameter method = "react" being specified. In

addition to the choice of the REACT algorithm, the following

R code also asks for the residuals, that should be

provided in the output. The same option (with the same functionality)

also applies for the PARALLAX algorithm (although it was not mentioned

in the section above).

react.cameron <- parallelReserve(cameron, method = "react", residuals = TRUE)

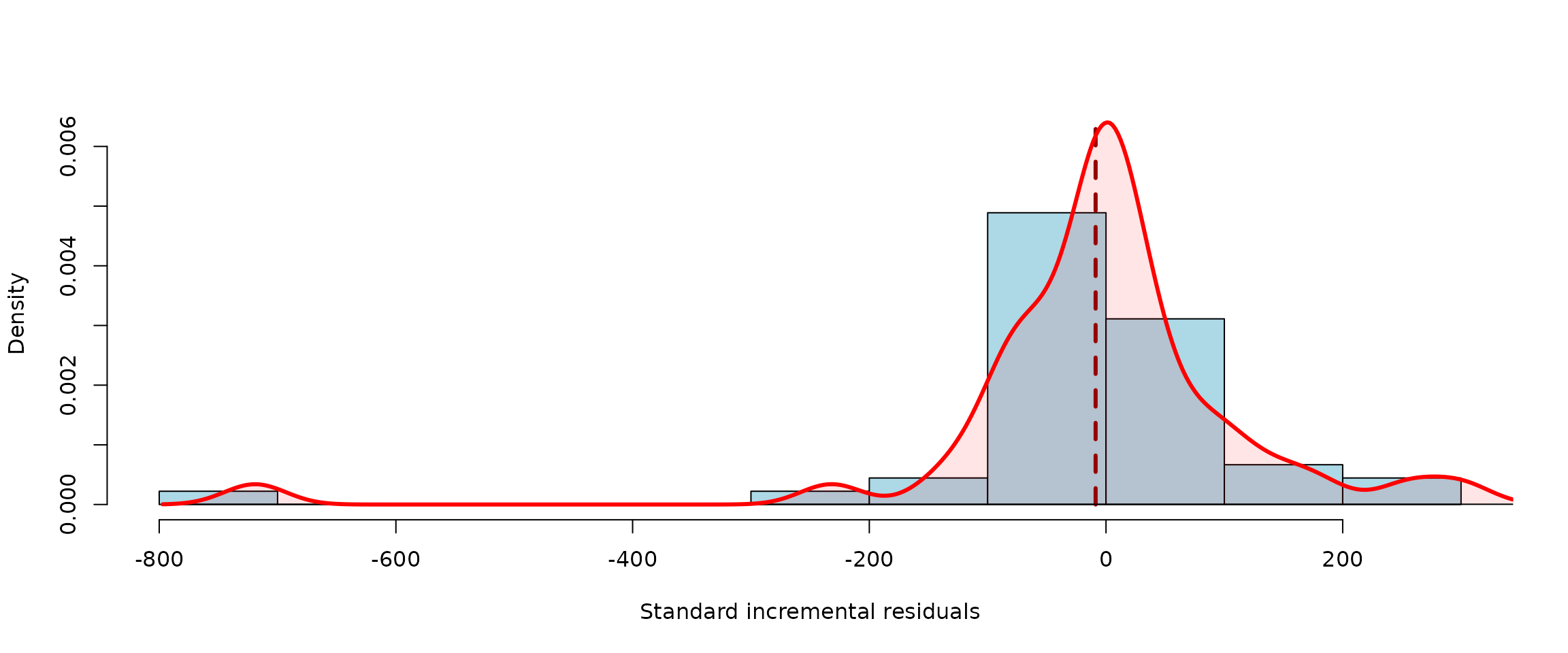

summary(react.cameron, plotOption = TRUE)## REACT reserve prediction (by origins)

## First Latest Dev.To.Date Ultimate IBNR

## 2 5984 13113 1.0000000 13113 0

## 3 7452 15720 0.9997456 15724 4

## 4 7115 13872 0.9937675 13959 87

## 5 5753 11282 0.9912142 11382 100

## 6 3937 8757 0.9725677 9004 247

## 7 5127 9325 0.9528919 9786 461

## 8 5046 8984 0.9172963 9794 810

## 9 5129 8202 0.8210210 9990 1788

## 10 3689 3689 0.4314620 8550 4861

## total 49232 92944 0.9174942 101302 8358## Overall reserve summary## Est.Reserve Est.Ultimate Paid Amount True Reserve Reserve%

## 8358.00 113517.00 105159.00 7963.00 4.96## Residual summary (standard incremental residuals)## Min 1st Q. Median Mean 3rd Q. Max Std.Er.

## -719 -49 -1 -9 34 300 143

##

## Total number of residuals: 45, Total number of unique residuals: 41

## Suspicious residuals (using 2σ rule): 2, Outliers (3σ rule): 1

Unlike the output from the PARALLAX algorithm, there is an additional

information about the incremental residuals provided in the output from

REACT. Residuals are typically used by actuaries to evaluate the

performance of the prediction. The residuals are available from the

corresponding list item $residulas (which is provided in

the output—the object of the class profileLadder—if the

residuals are selected, i.e., residuals = TRUE). The

residuals are defined as differences between true incremental payments

and the predicted ones _{i,j}$ and they can be also printed within the

triangle as

react.cameron$residuals## dev

## origin 1 2 3 4 5 6 7 8 9 10

## 1 NA NA NA NA NA NA NA NA NA NA

## 2 NA NA NA NA NA NA NA NA NA 2

## 3 NA NA NA NA NA NA NA NA 20 42

## 4 NA NA NA NA NA NA NA -20 34 -1

## 5 NA NA NA NA NA NA -40 -7 -3 22

## 6 NA NA NA NA NA -3 99 -84 30 118

## 7 NA NA NA NA 179 -70 25 -31 -73 -1

## 8 NA NA NA 300 255 -83 82 -92 -4 0

## 9 NA NA 5 147 56 -65 87 -34 -4 1

## 10 NA -719 -232 -49 -139 -114 43 -69 -5 0If there are no residuals provided in the output (i.e.,

residuals = FALSE) and the graphical option is set to

plotOption = TRUE, then slightly different figure (with the

prediction summary in terms of a barplot) is provided:

summary(parallelReserve(cameron, method = "react"), plotOption = TRUE)## REACT reserve prediction (by origins)

## First Latest Dev.To.Date Ultimate IBNR

## 2 5984 13113 1.0000000 13113 0

## 3 7452 15720 0.9997456 15724 4

## 4 7115 13872 0.9937675 13959 87

## 5 5753 11282 0.9912142 11382 100

## 6 3937 8757 0.9725677 9004 247

## 7 5127 9325 0.9528919 9786 461

## 8 5046 8984 0.9172963 9794 810

## 9 5129 8202 0.8210210 9990 1788

## 10 3689 3689 0.4314620 8550 4861

## total 49232 92944 0.9174942 101302 8358## Overall reserve summary## Est.Reserve Est.Ultimate Paid Amount True Reserve Reserve%

## 8358.00 113517.00 105159.00 7963.00 4.96

Note: There are two sets of residuals typically used

by actuaries and both of them can be provided in the output of the

parallelReserve() function. Either standard residuals in

terms of

are provided if the “future” (unknown) increments are available (for

instance, for some retrospective back-testing or validation purposes)

or, alternatively, so-called “back-fitted” residuals are calculated

instead.

The main idea behind the back-fitted residuals is to flip the completed triangle, transform it back to the run-off triangle by deleting the lower triangularpart, and to use such run-off triangle as an~input to back-predict the run-off triangle by applying the same estimation procedure inareverse manner so to say. Formally, the flipped matrix is a transposition with respect to the second diagonal—mathematically expressed, for a completed square , the “flipped triangle” is the square , where .

For illustration, and differences between the standard incremental residuals and the back-fitted residuals (that are more common in claims reserving practice), compare the following two outputs:

### standard residuals for a fully observed square

parallelReserve(cameron, method = "react", residuals = TRUE)$residuals

### backfitted residuals for the observed run-off triangle only

parallelReserve(observed(cameron), method = "react", residuals = TRUE)$residuals4. MACRAME

The idea of the MACRAME algorithm (MArkov Chain fRAgMEnt approximation) is to utilize a homogeneous Markov chain (MC) model to obtain the reserve prediction. This strategy is slightly different and more complex than the previous two; despite its additional mathematical complexity, however, it is quite intuitive and can be seen as a complex but rigorous generalization of the previous two algorithms described above. The underlying stochastic model invites additional user-defined adjustments and practically oriented modifications.

Unlike the previous two algorithms, MACRAME is based on the incremental run-off triangle. In the first step, the algorithm transforms the incremental payments into a finite set of states of a homogeneous Markov chain, , and the observed run-off triangle is used to estimate the matrix of the corresponding transition probabilities , for where the increment is represented by the Markov state from that is taken by . Thus, there are three pivots behind the MACRAME algorithm:

- Break points – the set of points ;

- Markov states – the set of points , where, typically, ;

- Transition matrix – the matrix with the corresponding estimates for the probabilities of transitions between the states.

The MACRAME algorithm is implemented in the R

function mcReserve() (from the ProfileLadder

package) using a similar scope as the parallelResrve()

function discussed above. The run-off triangle completion and the

reserve prediction obtained by the DEFAULT (data-driven) verion of the

MACRAME algorithm can be obtained by running

(macrame.cameron <- mcReserve(cameron))## MACRAME Reserving

## Estimated Reserve Estimated Ultimate Paid Amount

## 8081.963 113240.963 105159.000

## True Reserve

## 7963.000## MACRAME method (functional profile completion)## 5244 9228 10823 11352 11791 12082 12120 12199 12215 12215

## 5984 9939 11725 12346 12746 12909 13034 13109 13113 13160

## 7452 12421 14171 14752 15066 15354 15637 15720 15756 15799

## 7115 11117 12488 13274 13662 13859 13872 13919 13960 14003

## 5753 8969 9917 10697 11135 11282 11340 11380 11422 11464

## 3937 6524 7989 8543 8757 8815 8855 8897 8939 8982

## 5127 8212 8976 9325 9496 9588 9646 9693 9737 9780

## 5046 8006 8984 9677 10157 10458 10641 10759 10840 10902

## 5129 8202 9244 9808 10165 10376 10502 10586 10649 10701

## 3689 4731 5295 5652 5863 5989 6073 6136 6188 6236 The output of the MACRAME algorithm is again the S3 class object

profileLadder and, thus, the same S3 methods as before can

be applied again (in particuler, the following S3 methods are available:

print(), plot(), and summary()).

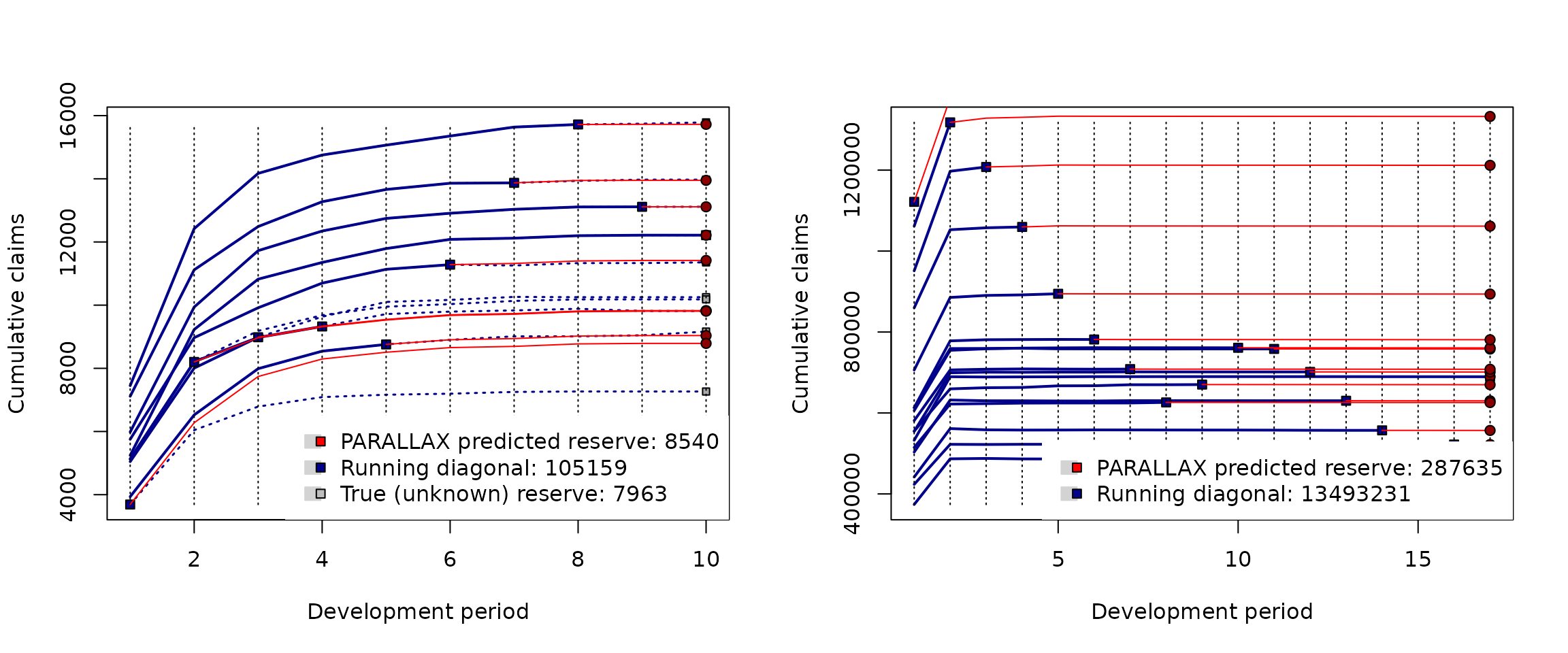

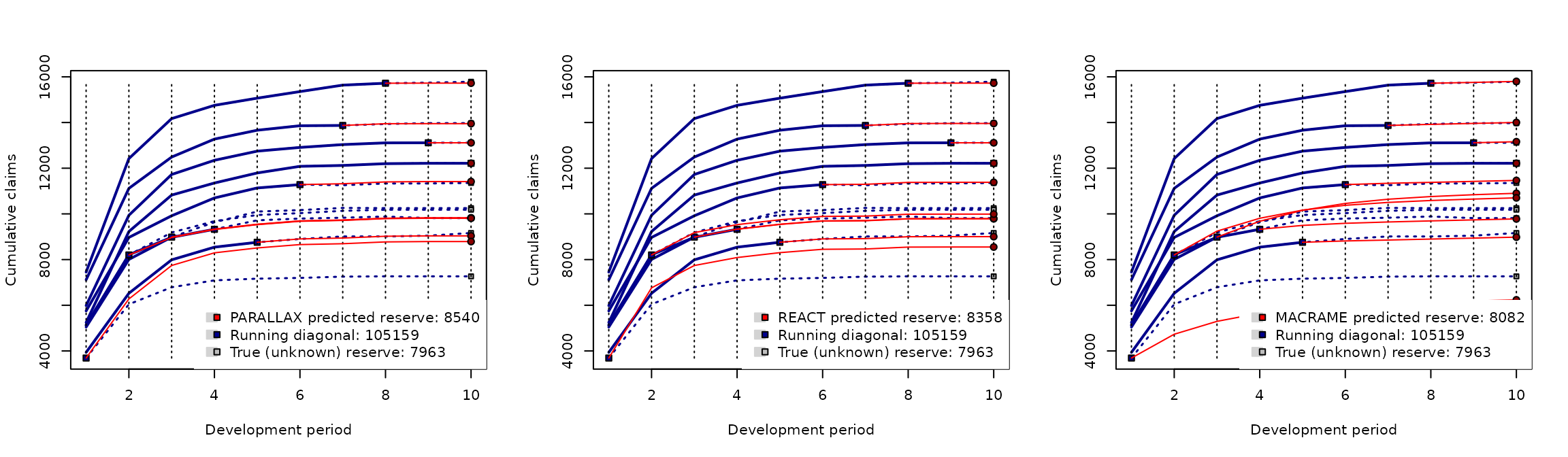

The performance of all three nonparametric prediction algorithms

(PARALLAX, REACT, and MACRAME) can be quantitatively and visually

compared (using the Cameron Mutual dataset).

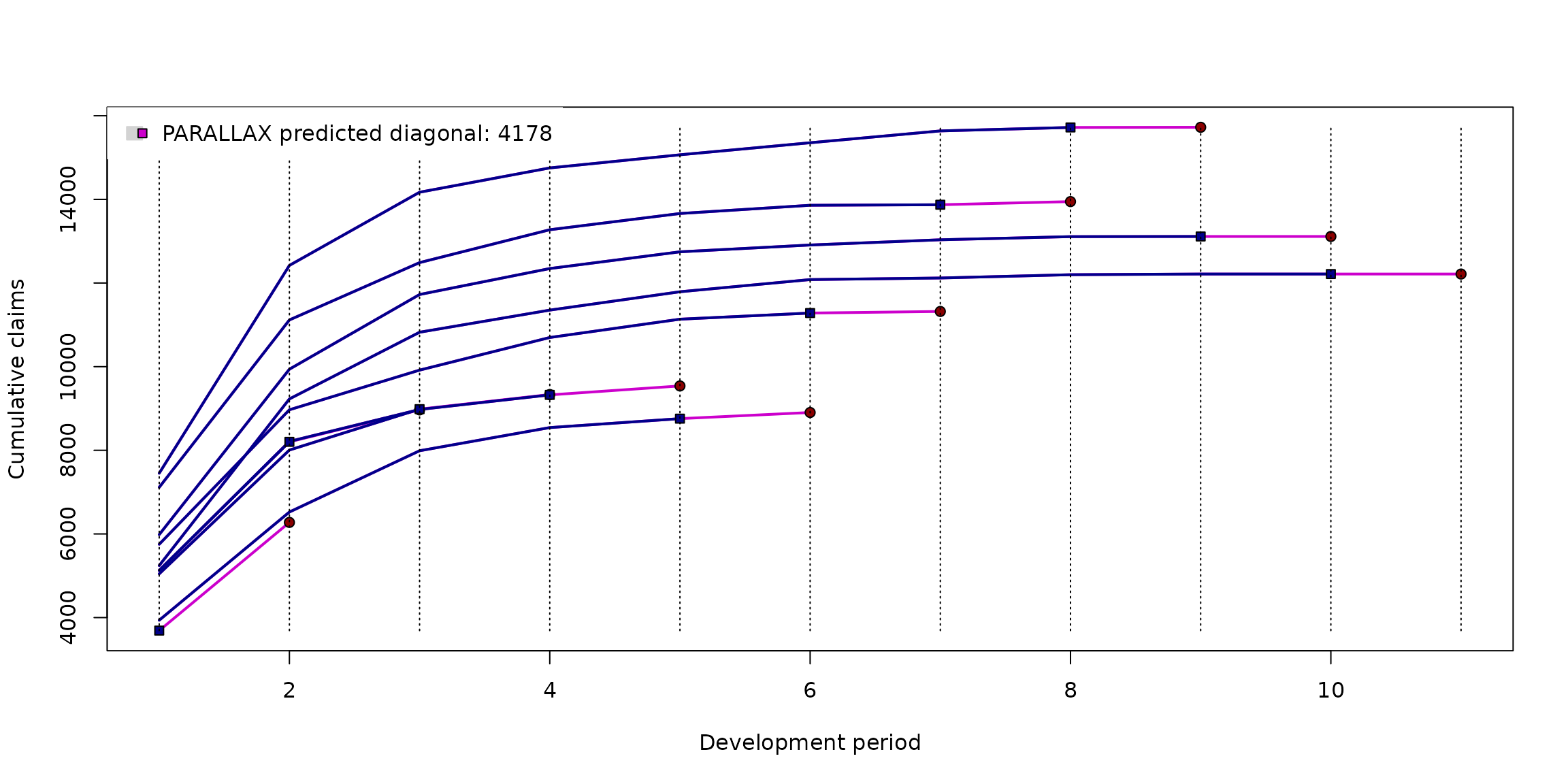

par(mfrow = c(1,3))

### PARALLAX reserve prediction and run-off completion

plot(parallelReserve(cameron))

### REACT reserve prediction and run-off completion

plot(parallelReserve(cameron, method = "react"))

### MACRAME reserve prediction and run-off completion

plot(mcReserve(cameron))

The red curve segments represent the predicted profile completions. The blue solid lines represent the available data—the underlyhing run-off triangle and the blue dotted lines stands for the “unknown” true developments (if available in the input data).

Recall, that the true reserve is . The reserve predictions provided by the proposed nonparametric reserving methods are

- PARALLAX:

- REACT:

- MACRAME:

This can be directly compared with the performance of some common

parametric reserving methods implemented in the ChainLadder

package:

- chainladder method (implemented in

chainladder()): - over-dispersed Poisson model (

glmReserve()): - Tweedie model (

tweedieReserve()):

The best reserve prediction (in terms of the smallest difference between the true reserve) is given by the MACRAME algorithm. More complex empirical comparisons can be found in Maciak, Mizera, and Pešta (2022).

The underlying stochastic model behind the MACRAME algorithm invites

additional user-defined adjustments and practically oriented

modifications; unlike the MACRAME algorithm described in Maciak, Mizera,

and Pešta (2022), where only a constrained and rather limited version of

the algorithm was proposed, the implementation in the R

function mcReserve() in the ProfileLadder

package allows for all kinds of fine tuning and user-based

modifications. Specific details can be either found in Maciak, Matúš,

Mizera, and Pešta (2026) or in the package documentation (GitHub or CRAN).

Maciak, M., Mizera, I., and Pešta, M. (2022). Functional Profile Techniques for Claims Reserving. ASTIN Bulletin, 52(2), 449 – 482. DOI: 10.1017/asb.2022.4

Maciak, M., Matúš, R., Mizera, I., and Pešta, M. (2026). ProfileLadder: Functional-Based Reserving. The R journal, (to appear). URL: https://journal.r-project.org/issues.htmlUser-based modifications of MACRAME

The implementation of the algorithm in the R function

mcReserve() allows users to intervene with various

modifications—starting with a pre-specified

number of the Markov states to be required, selecting the method how the

run-off triangle increments are summarized into the states, or providing

a fully manual specification of the states

,

breaks

,

or the subset of increments to be used.

Details (that are omitted here) can be found in the R help session

for the mcReserve() function by typing

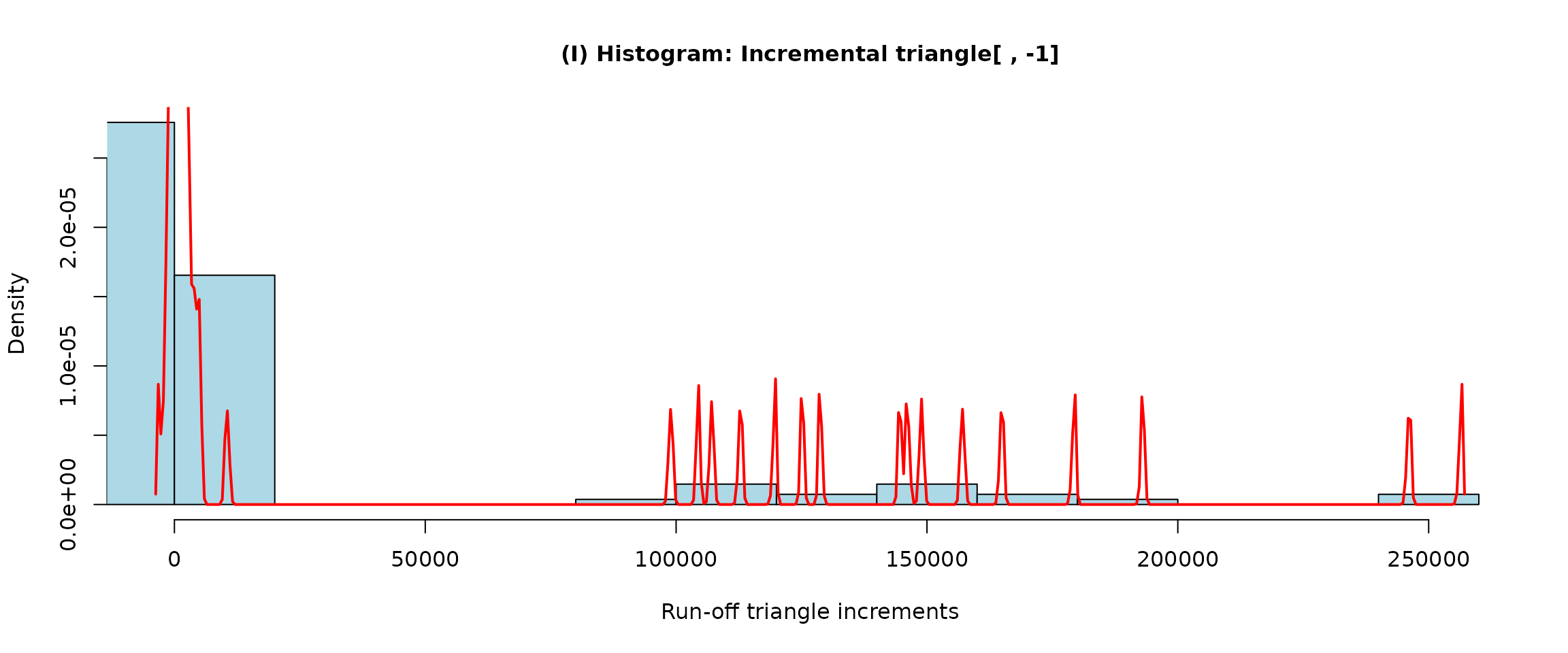

help("mcReserve")In order to get some useful insight about the structure of the

incremental run-off triangle and to offer some visual inspection for

various user-based modifications of the underlying Markov chain in the

mcReserve() function, there is another practical tool

implemented in the ProfileLadder package—function

incrExplor().

The function takes the run-off triangle as an input (fully observed

or not, incremental or cumulative) and returns a complex empirical

exploration of the incremental payments (that are used by

macrame() to set the Markov chain within the MACRAME

algorithm).

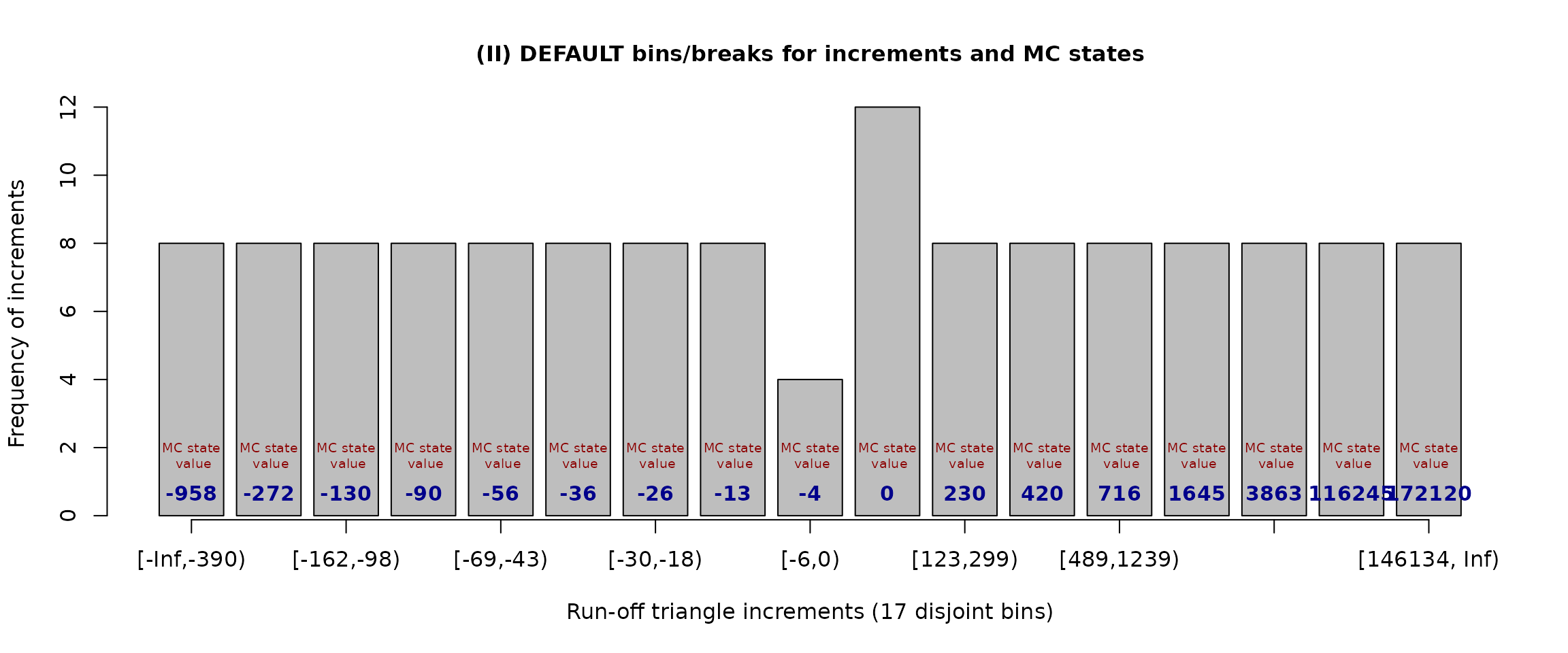

The default performance of the incrExplor() function

returns a fully data-driven setup of the underlying Markov chain—the set

of the data-driven Markov states and the corresponding set of break

points:

(exploratory.casco <- incrExplor(casco))## Data-driven (default) setting of the Markov Chain in MACRAME## MC States: -957.5 -272 -129.5 -90 -55.5 -35.5 -25.5 -13 -4 0 230.5 420 716.5 1645 3863 116245 172120.5

##

## Corresponding bins for the run-off triangle increments

## [1] "[-Inf, -390)" "[-390, -162)" "[-162, -98)" "[-98, -69)"

## [5] "[-69, -43)" "[-43, -30)" "[-30, -18)" "[-18, -6)"

## [9] "[-6, 0)" "[0, 123)" "[123, 299)" "[299, 489)"

## [13] "[489, 1239)" "[1239, 2725)" "[2725, 98941)" "[98941, 146134)"

## [17] "[146134, Inf)"The output from the incrExplor() function is an object

of the S3 class mcSetup and the S3 methods

summary() and plot() can be applied to get

further details.

summary(exploratory.casco)## Input triangle type: Cumulative## Summary of the increments

## Min 1st Q. Median Mean 3rd Q. Max

## Raw increments -3028.0000 -62.0000 -2 18235.0000 867.0000 256454

## Std. increments -0.0118 -0.0002 0 0.0711 0.0034 1

## Std.Er.

## Raw increments 51534.0000

## Std. increments 0.2009

##

## Total number of increments: 136, Total number of unique increments: 121

## Number of suspicious increments (using 2σ rule): 15, Outliers (3σ rule): 6

##

## Data-driven bins for the run-off triangle increments

## [1] "[-Inf, -390)" "[-390, -162)" "[-162, -98)" "[-98, -69)"

## [5] "[-69, -43)" "[-43, -30)" "[-30, -18)" "[-18, -6)"

## [9] "[-6, 0)" "[0, 123)" "[123, 299)" "[299, 489)"

## [13] "[489, 1239)" "[1239, 2725)" "[2725, 98941)" "[98941, 146134)"

## [17] "[146134, Inf)"

##

## Markov Chain states (medians of the increments within each bin)

## [1] -957.5 -272.0 -129.5 -90.0 -55.5 -35.5 -25.5 -13.0

## [9] -4.0 0.0 230.5 420.0 716.5 1645.0 3863.0 116245.0

## [17] 172120.5

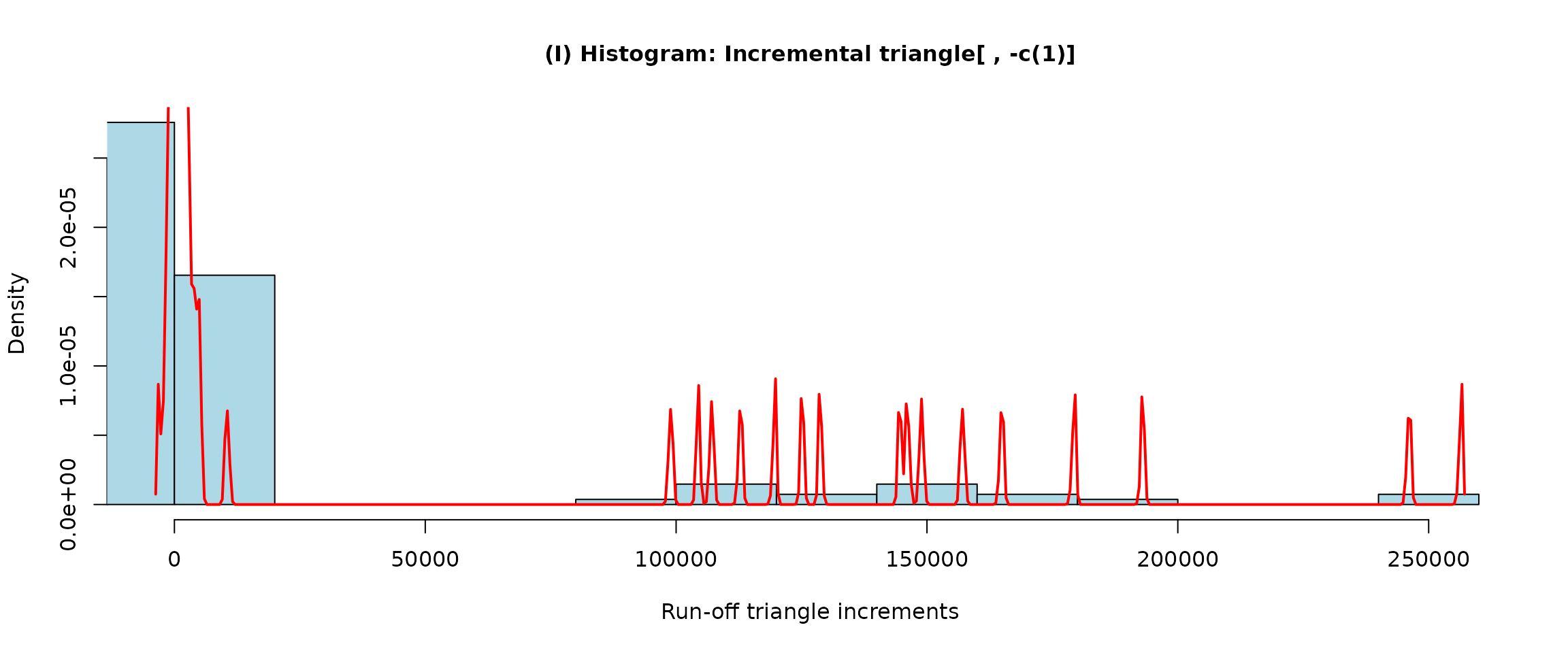

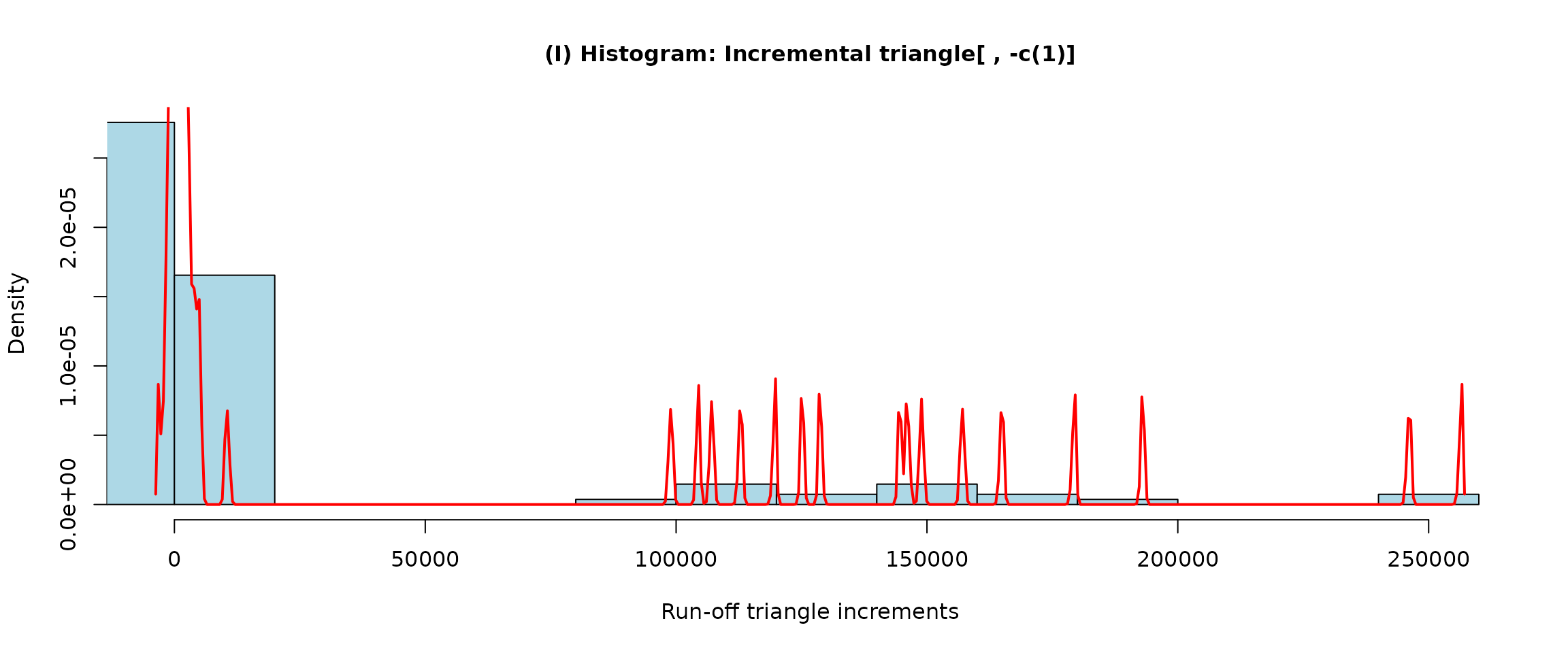

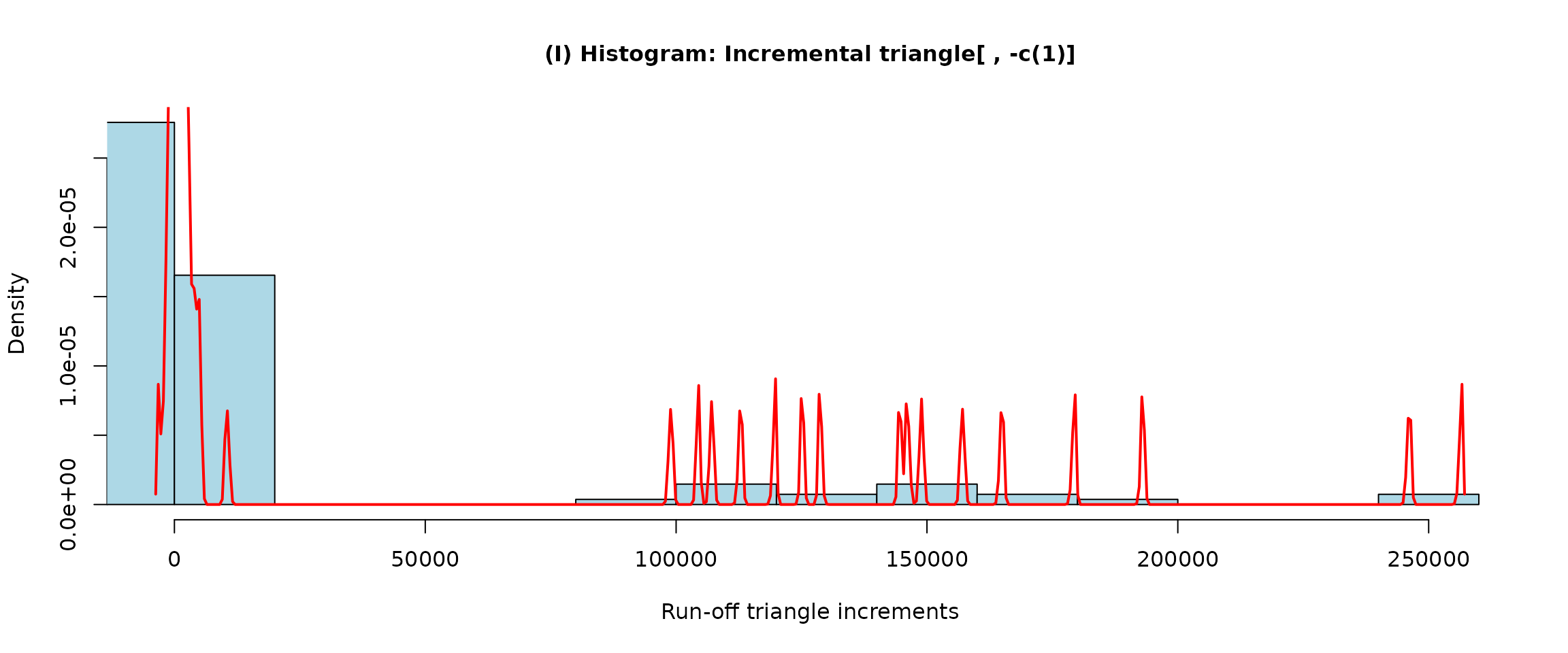

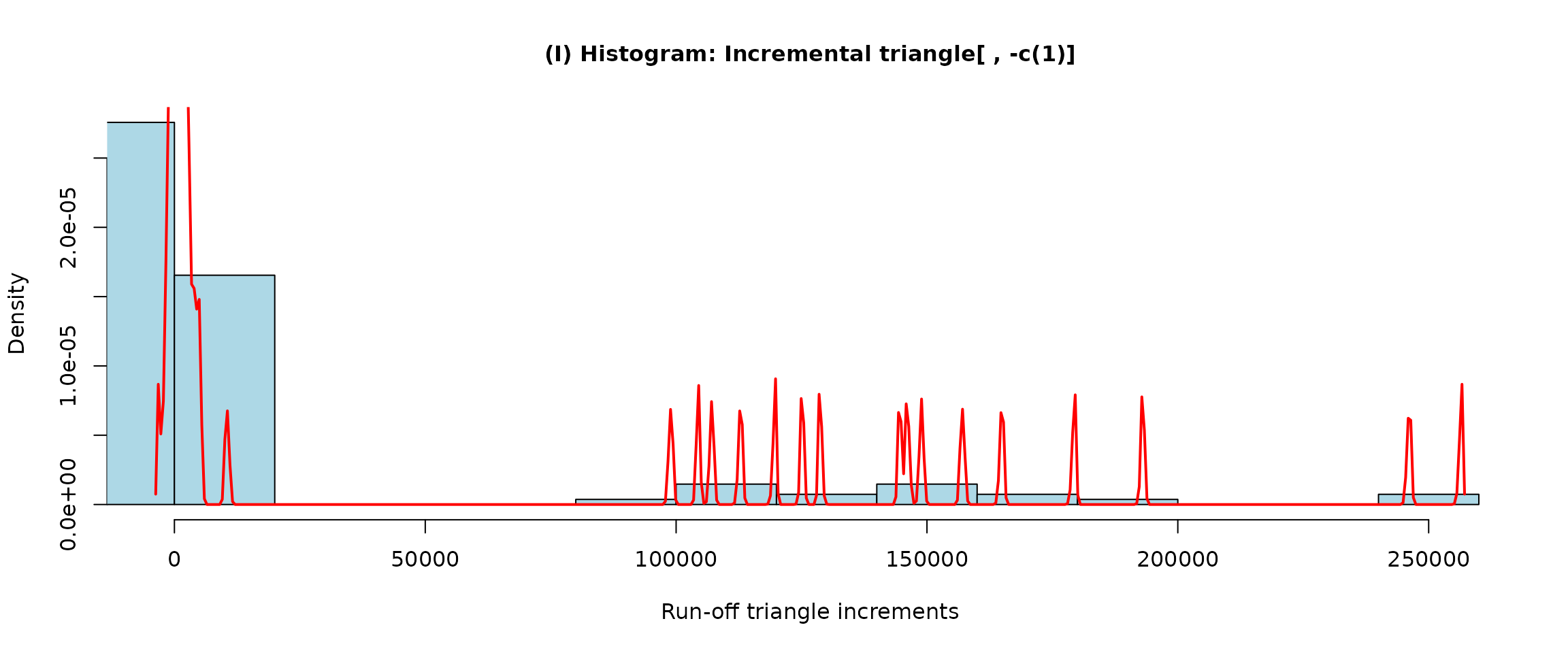

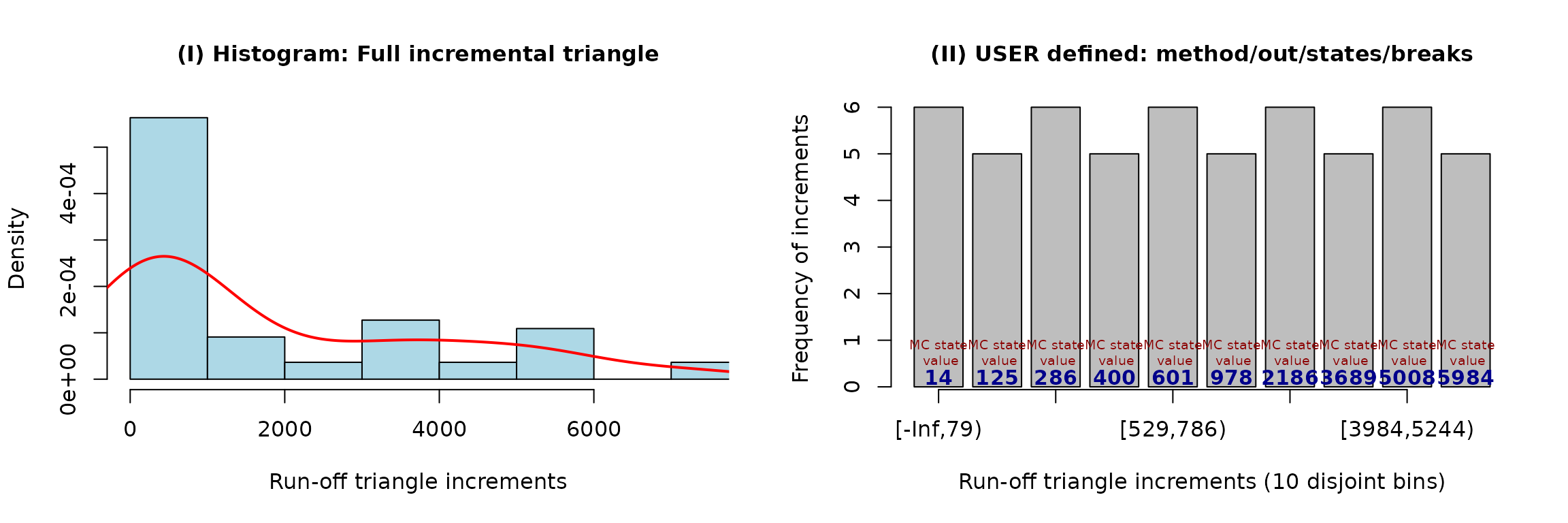

plot(exploratory.casco)

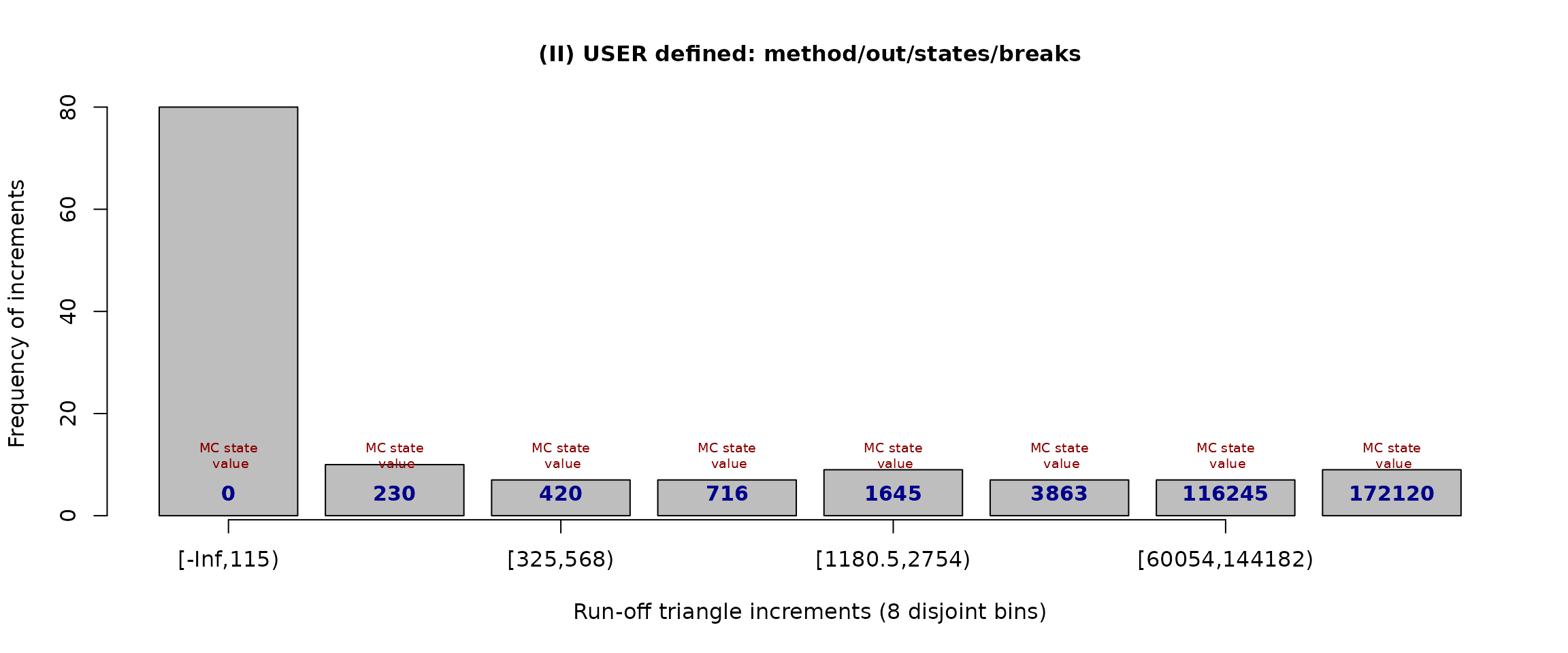

Using the barplot figure above, the break-points are listed as interval labels on the axis. The Markov states (taken by default as medians of the increments belonging to a specific interval defined by two consecutive break points) are given as the blue labes within the bars.

The data-driven method for defining the break points and the corresponding Markov states (that are provided in the outputs above) is described and theoretically justified in Maciak, Mizera, and Pešta (2022). Further details are omiited here.

Possible user-based modifications are described in the following sections.

a) Modifying the underlying Markov states

It can be noticed from the barplot above that there are relatively many small (negative) Markov states (-957.5, -272.0, -129.5, etc.) that are due to many rather small negative increments while there are much more important (from the reserve prediction point of view) and much larger positive claim payments that are reflected in a roughly same amount of positive Markov states.

Thus, it could be interesting to modify the underlying Markov chain

in a way that all negative increments are rather ignored—for instance,

by introducing just one state for all zero and negative payments—and to

focuss more on crutial claim payments that may heavily effect the final

reserve. This can be done by the additional parameter

states = ... which is implemented in both functions—the

exploratory function incrExplor() and the prediction

algorithm mcReserve().

In the following outputs, there are eight explicit Markov states used

(c(0, 230, 420, 716, 1645, 3863, 116245, 172120)) and the

corrresponding break points

are determined as middle points between two consecutive Markov states

(with

and

):

plot(modification.1 <- incrExplor(casco, states = c(0, 230, 420, 716, 1645, 3863, 116245, 172120)))

The same set of Markov states can be analogously used to run the MACRAME prediction (the output is omitted for brevity):

All negative and small (i.e., below

)

increments are now represented by one Markov state (zero) and other

incremental payments are represented by the remaining seven

pre-specified states. The MACRAME prediction with the same set of states

can be performed by the mcReserve() function by using the

dedicated accesor method mcStates() as follows

(alternatively, the sequence of the states can be also plugged in

explicitly):

The run-off triangle incremental payments are no longer equally distributed among the bins—this can be only achieved if the break points are calculated in the proposed data-driven manner.

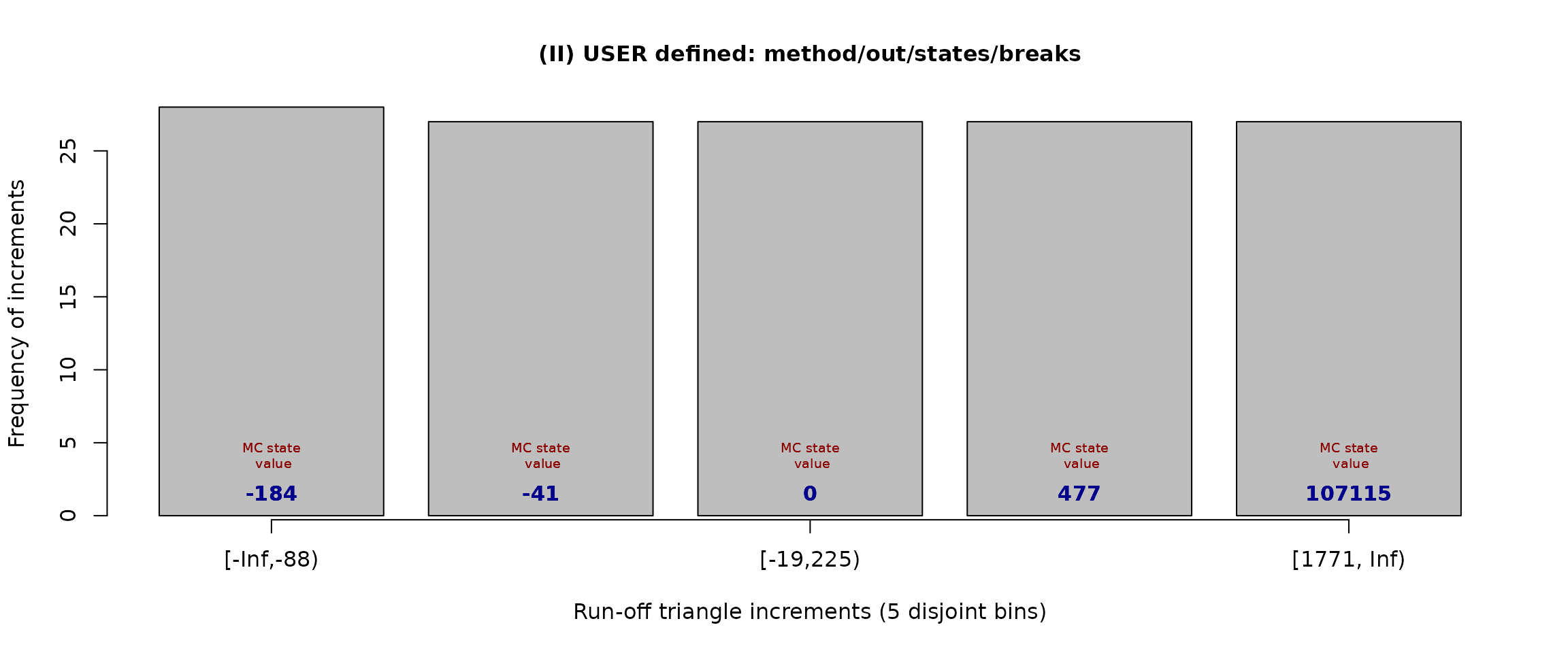

However, the states parameter can be also specified

differently. Instead of specifying the underlying set of the Markov

states it can be used to change the amount of the states. For instance,

the choice states = 5 will result in five Markov states

and, again, the increments will be distributed equally (as much as

possible). This can be also verified visually by

plot(incrExplor(casco, states = 5))

The same Markov states (rounded in the figure above) will be used by

the MACRAME algorithm when specifying the same amount of the Markov

states, i.e., state = 5. This can be directly veryfied by

the following:

## [1] -184.5 -41.0 0.0 477.0 107115.0The corresponding break points are

mcBreaks(macrame.s5.casco)## [1] -Inf -88 -19 225 1771 Infand the transition matrix with the estimated transition probabilities is

mcTrans(macrame.s5.casco)## [,1] [,2] [,3] [,4] [,5]

## [1,] 0.2801 0.1960 0.3839 0.1400 0.0000

## [2,] 0.1644 0.2959 0.4740 0.0658 0.0000

## [3,] 0.0000 0.0000 1.0000 0.0000 0.0000

## [4,] 0.2206 0.1575 0.3383 0.1890 0.0945

## [5,] 0.1315 0.0000 0.2767 0.3288 0.2630b) Specifying explict break points

Another parameter implemented for user modifications of the Markov

chain in the MACRAME algorithm is the parameter breaks

which can be used to explicitly provide the set of break points for the

run-off triangle increments.

However, a valid sequence of the break points—in a sense that —must be provided. The first and the last break point ( and ) may or may not be specified. On the other hand, two consecutive break points always need to contain at least one incremental payment in between—otherwise, such consecutive bins are merged together to form a new one.

Going back to the Casco incurance data where many negative increments were noticed, it can be more appropriate to alter the underlying Markov chain by providing a different set of break points (rather than changing directly the Markov states). In such a way, the corresponding Markov states will be still obtained using a statistical summary method (by default, the Markov states are medians of the increments within the bins).

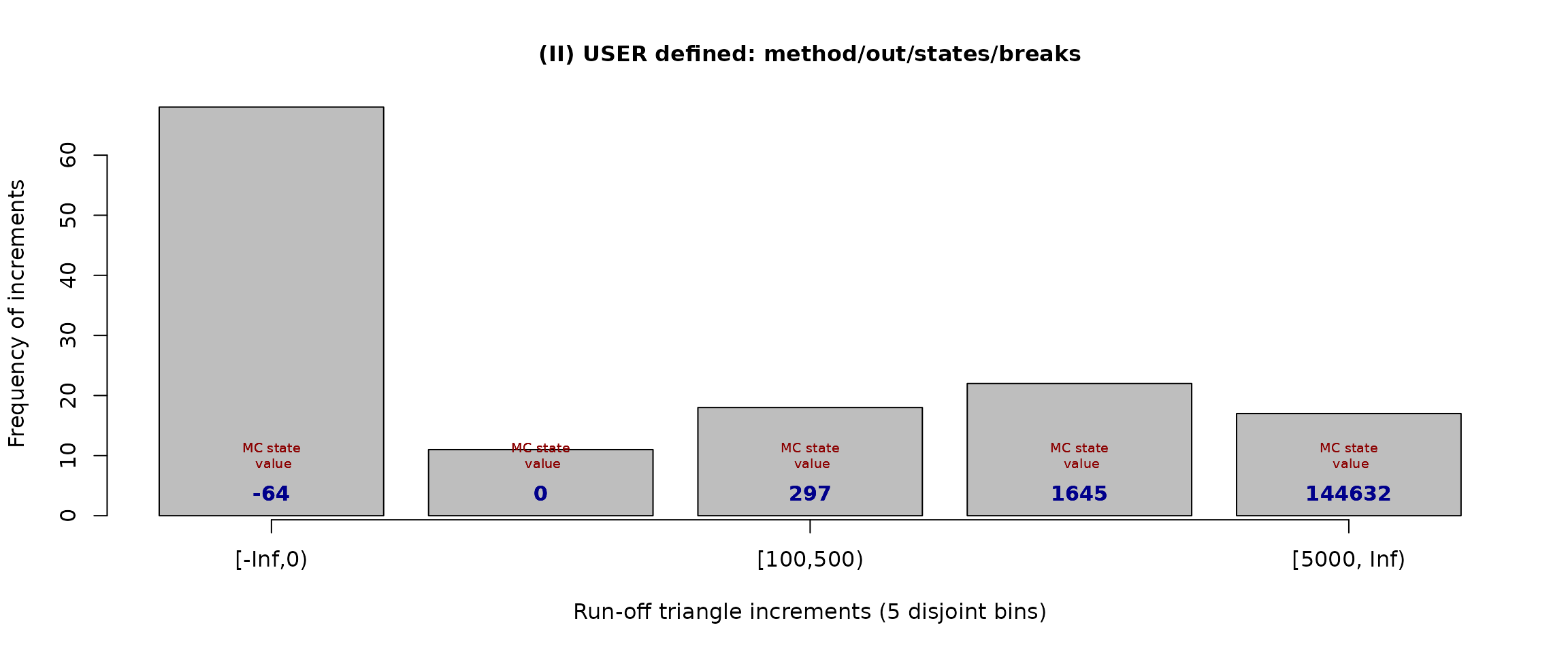

The default break points are determined in a way that the increments are equaly distributed among 17 non-overlapping bins (where the number of bins being used is, by default, same as the dimension of the run-off triangle). For instance, five bins with explicit breaks points can be obtained by

plot(modification.2 <- incrExplor(casco, breaks = c(0, 100, 500, 5000)))

and the same resuld will be also obtained for any of the following (outputs are omitted):

incrExplor(casco, breaks = c(-Inf, 0, 100, 500, 5000))

incrExplor(casco, breaks = c(0, 100, 500, 5000, Inf))

incrExplor(casco, breaks = c(-Inf, 0, 100, 500, 5000, Inf))The corresponding Markov states are calculated (by default) as

medians of the increments within each bin and they can be assessed by

using the mcStates() function

mcStates(modification.2)## [1] -63.5 0.0 297.0 1645.0 144632.0The corresponding MACRAME reserve prediction using the same break points (and the corresponding Markov states as well) is obtained analogously by

## MACRAME reserve prediction (by origins)

## First Latest Dev.To.Date Ultimate IBNR

## 2 423582 522003 0.9999172 522046.2 43.2500

## 3 373866 485984 1.0000000 485984.0 0.0000

## 4 441769 557049 0.9996132 557264.5 215.5362

## 5 503292 630271 1.0000000 630271.0 0.0000

## 6 554625 701433 1.0000000 701433.0 0.0000

## 7 613011 758233 0.9993793 758703.9 470.9047

## 8 605922 761068 0.9992867 761611.3 543.2598

## 9 555154 670158 0.9988864 670905.1 747.1026

## 10 514900 626112 0.9965579 628274.6 2162.6048

## 11 581196 708428 0.9988083 709273.2 845.2127

## 12 613266 781561 0.9990129 782333.3 772.2756

## 13 706120 894514 0.9973982 896847.4 2333.3986

## 14 859707 1059593 0.9977591 1061972.8 2379.7958

## 15 951189 1207771 0.9891633 1221002.6 13231.6383

## 16 1061511 1317965 0.9900306 1331236.6 13271.6275

## 17 1121591 1121591 0.9882740 1134898.8 13307.8470

## total 10480701 12803734 0.9960849 12854058.5 50324.4536## Overall reserve summary## Est.Reserve Est.Ultimate Paid Amount True Reserve Reserve%

## 50324.45 13543555.45 13493231.00 NA NAc) Summary method for incremental payments

Instead of summarizing the increments within each bin by considering

the median value, another method can be specified by another parameter

method which can take on of four values:

"median" (default); "mean",

"min", and "max".

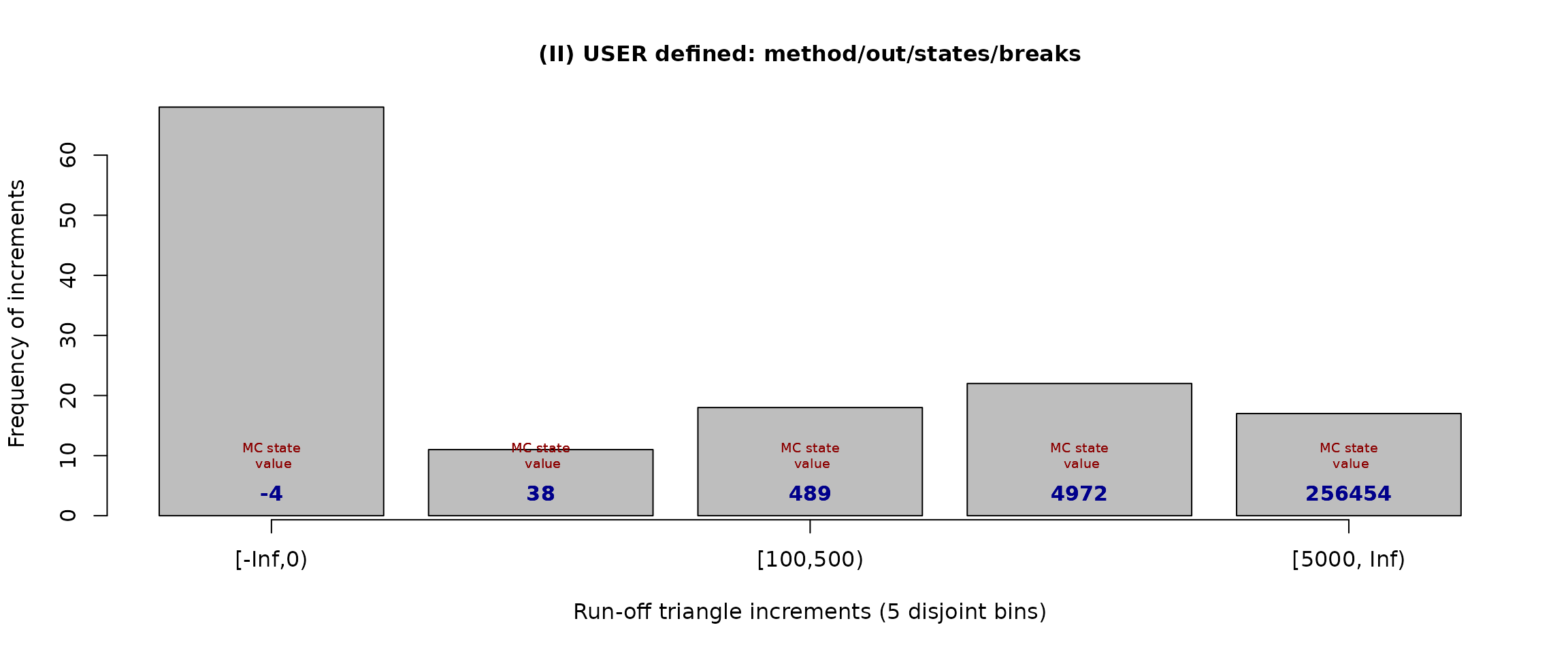

Thus, considering the same set of breaks as before, it can be of some interest to define Markov states not as medians of the increments within each bin but taking maximum in every bin instead. This can be easily achieved by

new.breaks <- c(0, 100, 500, 5000)

exploratory.casco2 <- incrExplor(casco, breaks = new.breaks, method = "max")

plot(exploratory.casco2)

The parameter method is only available for the

exploratory function incrExplor() and, unlike the

parameters states and breaks, it is not

implemented in the mcReserve() function. This is, however,

not limiting with respect to the performance of the MACRAME algorithm

implemented within mcReserve(). Indeed, the parameter

method = c("median", "mean", "min", "max") is used to

summarize the increments within each bin defined by the break points in

breaks = ... and the corresponding Markov states can be

assessed from the incrExplor() function by using the

appropriate accessor method, the function mcStates().

Consequently, both the breaks (provided explicitly) and the states

(obtained as maximal increments within each bin) can be forwarded into

the mcReserve() function to set up the MACRAME algorithm

correspondingly (output is omitted again):

The previous also implies that users can fully manually set the breaks and the Markov states when running the MACRAME algorithm. A valid set of breaks is needed and the states must be always provided in a way, that exactly one Markov state belongs to one interval determined by two consecutive break points. More details can be found the package documentation—particularly in the following two help sessions

Note: There are four parameters implemented in the

incrExplor() function to help users to properly tune the

underlying Markov chain for the MACRAME prediction

(breaks = ..., states = ...,

method = ..., and out = ...). On the other

hand, there are only two parameters used within the

mcReserve() function.

The summary method for run-off triangle increments can be enforced

within the mcReserve() function by using the appropriate

accessor functions:

-

mcBreaks()– function for extracting the set of break points fromincrExplor()ormcReserve(); -

mcStates()– function for extracting the Markov states fromincrExplor()ormcReserve(); -

mcTrans()– function to extract the estimated transition matrix frommcReserve().

Note that the mcTrans() function can be only applied to

the output of the mcReserve() function as there is not

transition probability estimation in the exploratory tool

incrExplor().

out = ... implemented in the

incrExplor() function is discussed in the next section.

d) Subsets of incremental payments

The default functionality of the incrExplor() function

is to provide users with the data-driven set of bins (the break points

respectively) and the corresponding Markov states for the underlying

run-off triangle. The first year payments in the run-off triagnle are

not considered by default (further discussion is provided in Maciak,

Mizera, and Pešta, 2022), but this restriction can be also altered—if

needed.

If there is a specific interest to also include the first year

payments when defining the Markov chain states and the corresponding

break points (or, alternatively, to exclude some other columns with the

incremental payments), an additional parameter out = 1

(default) can be changed correspondingly—the default value stands for

the first year increments that are typically not considered; the choice

out = 0 uses all available increments

,

for

and

;

in order to exclude, for example, first three columns, the parameter can

be specified as out = c(1,2,3). The change of this

parameter is also reflected by the output of incrExplor()

which, in addition, contains analogous information as before, however,

for a user-modified subset of the incremental payments.

incrExplor(cameron, out = 0)## Data-driven (default) setting of the Markov Chain in MACRAME## MC States: 13 81 197 302.5 438 601 948 1672.5 3073 3993

##

## Corresponding bins for the run-off triangle increments

## [1] "[-Inf, 75)" "[75, 147)" "[147, 288)" "[288, 388)" "[388, 554)"

## [6] "[554, 780)" "[780, 1465)" "[1465, 2587)" "[2587, 3955)" "[3955, Inf)"## User-modified MC setting## MC States: 14.5 125 285.5 400 601 978 2186.5 3689 5007.5 5984

##

## Corresponding bins for the run-off triangle increments

## [1] "[-Inf, 79)" "[79, 197)" "[197, 349)" "[349, 529)" "[529, 786)"

## [6] "[786, 1595)" "[1595, 3085)" "[3085, 3984)" "[3984, 5244)" "[5244, Inf)"

##

## Development periods (run-off triangle columns) not considered: 0

## Method selected to summarize the increments within each bin: DEFAULT (median)The S3 method plot() can be applied to obtain some

graphical visualization of the user-defined subset of increments and

their overall summary (together with the comparison with the default

selection).

par(mfrow = c(1,2))

plot(incrExplor(cameron, out = 0))

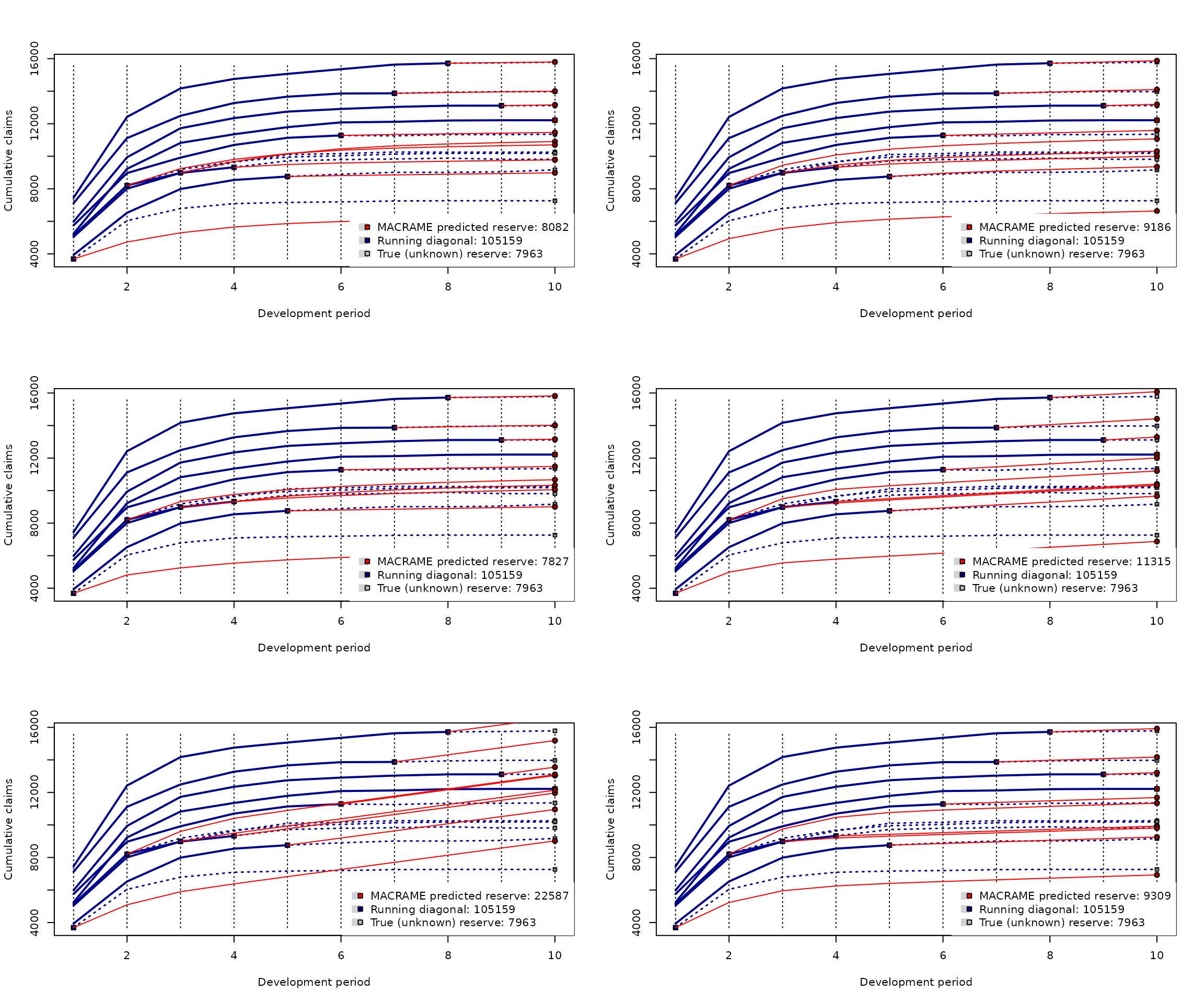

e) Illustration of different MACRAME settings

Different settings for the break points and the Markov states result in different reserve predictions (and the corresponding missing profiles completions). In the following, there is again the Cameron Mutual dataset used (with the known true reserve 7963) with the predicted reserves ranging from 7827 (slightly underestimated reserve) up to 22587 (heavily overestimated reserve).

Various user-based modifications are used for the MACRAME predictions below (the first one being the default performance).

par(mfrow = c(3,2))

plot(mcReserve(cameron)) ### default setting with 10 MC states

plot(mcReserve(cameron, states = 4)) ### four states (otherwise default)

plot(mcReserve(cameron, states = c(50, 500, 1500, 3000))) ### explicit states

plot(mcReserve(cameron, breaks = c(500, 1000, 1500, 2000))) ### explicit breaks

user.breaks <- c(500, 1000, 1500, 2000)

user.method <- incrExplor(cameron, breaks = user.breaks, method = "max")

final.states <- mcStates(user.method)

### explicit breaks and Markov states as maximma

plot(mcReserve(cameron, breaks = user.breaks, states = final.states))

### explicit breaks and explicit states

plot(mcReserve(cameron, breaks = c(500, 1000, 1500), states = c(100, 999, 1001, 3000)))

Note: The default performance of the MACRAME algorithm

implemented by the R function mcReserve()

is fully-data driven and it fully corresponds with the breaks and Markov

states as proposed and theoretically justified in Maciak, Mizera, and

Pešta, (2022).

5. Permutation bootstrap

The reserve prediction for the unknown claims reserve provides only a partial information in the entire loss reserving problem. In practice, a prediction of the whole reserve distribution is required too (for instance, by risk reserving assessment guidelines like Solvency II).

Classical techniques employ a residual (parametric or semiparametric)

bootstrap approach (typically based on the back-fitted residuals) to

emulate the distribution of interest. However, for the functional-based

claims reserving there is a different strategy: permutation bootstrap.

The prediction of the reserve distribution is still obtained via

bootstrap resampling, but the algorithm avoids the use of residuals by

resampling (permuting) the whole functional profiles. The rows of the

completed run-off triangle produced by a certain algorithm—by each of

those described above, but also any of the classical parametric

reserving models implemented in the ChainLadder package—are

treated as independent functional profiles. The completed triangle, the

data matrix

,

can be standardized: each row is divided by the first positive value

within the row (considered from the left—which is, very likely, the

first incremental payment in each row). The standardization step is

proposed on the grounds that it is very typical in practice that the

claims amounts paid in the first development period substantially

increase over the years (possibly the effect of economical growth,

inflation, more advanced or more expensive technology, etc.). The

standardization is set as a default, but the user can suppress it if

desiring so.

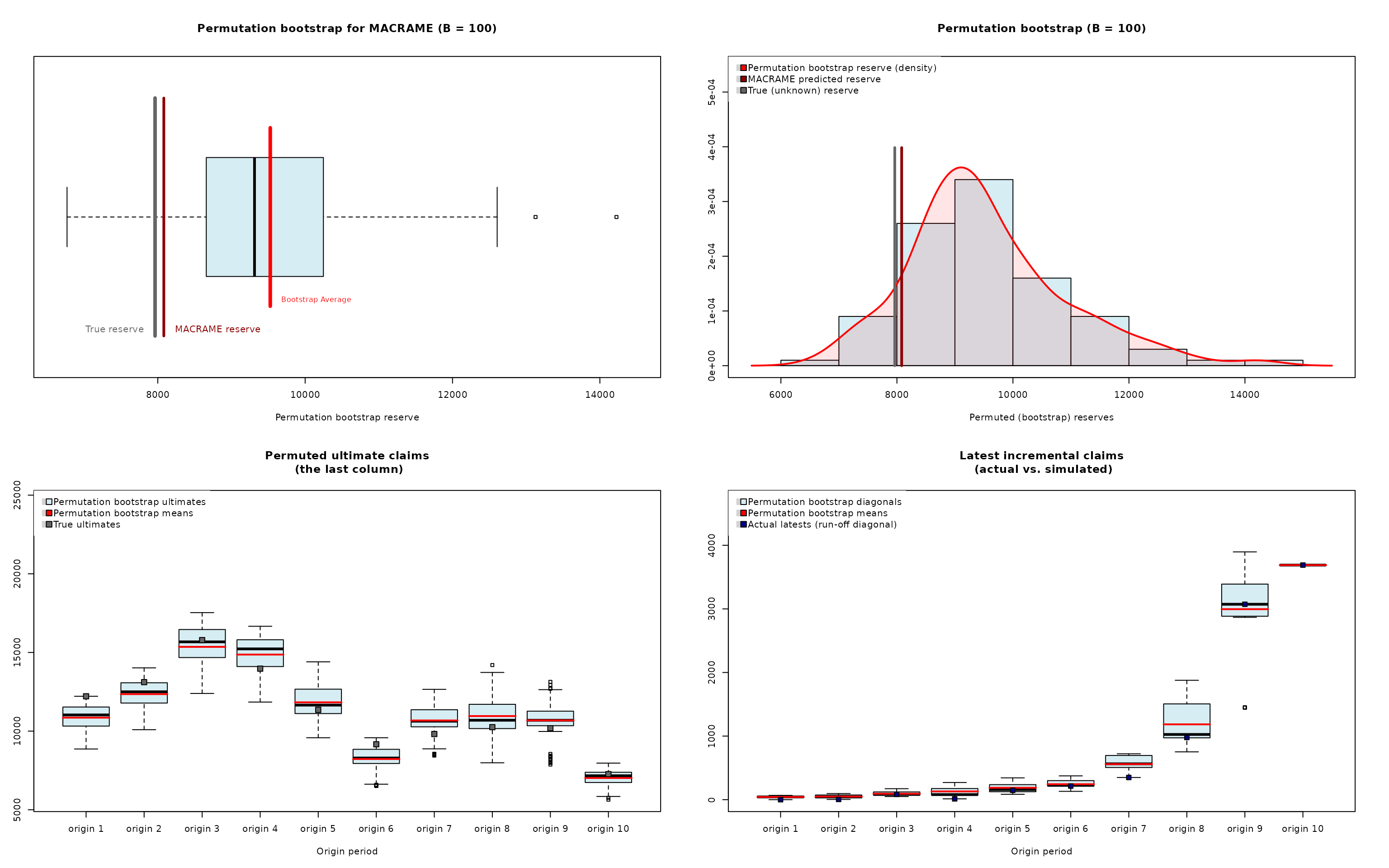

permute.cameron <- permuteReserve(mcReserve(cameron), B = 100)The output from the permuteReserve() function is an

object of the S3 class permutedReserve and S3 methods

summary() or plot() can be applied to get more

detailed information:

summary(permute.cameron)## MACRAME based reserve prediction (with B = 100 bootstrap permutations)

## First Latest Dev.To.Date Ultimate IBNR S.E CV

## 2 5984 13113 0.9964286 13160.000 47.00000 20.35946 0.4331799

## 3 7452 15720 0.9950067 15798.889 78.88889 38.10804 0.4830597

## 4 7115 13872 0.9906724 14002.611 130.61111 116.55286 0.8923656

## 5 5753 11282 0.9840866 11464.438 182.43827 158.73832 0.8700933

## 6 3937 8757 0.9749940 8981.594 224.59362 125.88048 0.5604811

## 7 5127 9325 0.9535135 9779.620 454.61986 253.74400 0.5581455

## 8 5046 8984 0.8241040 10901.537 1917.53724 552.09226 0.2879174

## 9 5129 8202 0.7664369 10701.468 2499.46806 644.56539 0.2578810

## 10 3689 3689 0.5915835 6235.806 2546.80632 523.25414 0.2054550

## total 49232 92944 0.9200011 101025.963 8081.96337 1348.35146 0.1668346## Overall reserve distribution## Boot.Mean Std.Er. BootCov% BootVar.995

## 9526.563369 1348.351459 14.153598 1.436145

##

## The MACRAME predicted reserve represents the 10.89% quantile of the reserve distribution

## Bootstrap simulated reserves beyond 2σ rule: 5 (out of 100)

plot(permute.cameron)

Note that in the summary output above there already colums

S.E. and CV provided and they can be directly

compared with the values obtained from the distributional assumption

(using, for instance, the over-dispersed Poisson model) from the

ChainLadder package

summary(glmReserve(observed(cameron)))## Latest Dev.To.Date Ultimate IBNR S.E CV

## 2 13113 1.0000000 13113 0 0.01035287 Inf

## 3 15720 0.9992372 15732 12 29.38975320 2.4491461

## 4 13872 0.9934116 13964 92 73.46098788 0.7984890

## 5 11282 0.9850694 11453 171 96.26787355 0.5629700

## 6 8757 0.9688019 9039 282 120.58781735 0.4276164

## 7 9325 0.9397360 9923 598 177.57019068 0.2969401

## 8 8984 0.8905630 10088 1104 246.00693847 0.2228324

## 9 8202 0.7789914 10529 2327 379.54811405 0.1631062

## 10 3689 0.4788422 7704 4015 622.22022041 0.1549739

## total 92944 0.9152986 101545 8601 880.66723938 0.1023913

Note: The permutation bootstrap implemented in the

R function permuteReserve() (from the

R package ProfileLadder) handles not only

objects created by the parallelReserve() function and the

mcReserve() function (thus, S3 objects of the class

profileLadder) but it also works with the objects generated

by the classical reserving techniques—those implemented in the

R package ChainLadder (in particular, the

over-dispersed Poisson model, the Mack model, chainladder model, or the

Tweedie formula).

Note also the same layout used for the S3 method plot()

when applied to the output of the permutation bootstrap function

pemuteReserve() as the one adoped for the residual

bootstrap resampling in classical parametric chainladder based

methods:

plot(BootChainLadder(observed(cameron)))

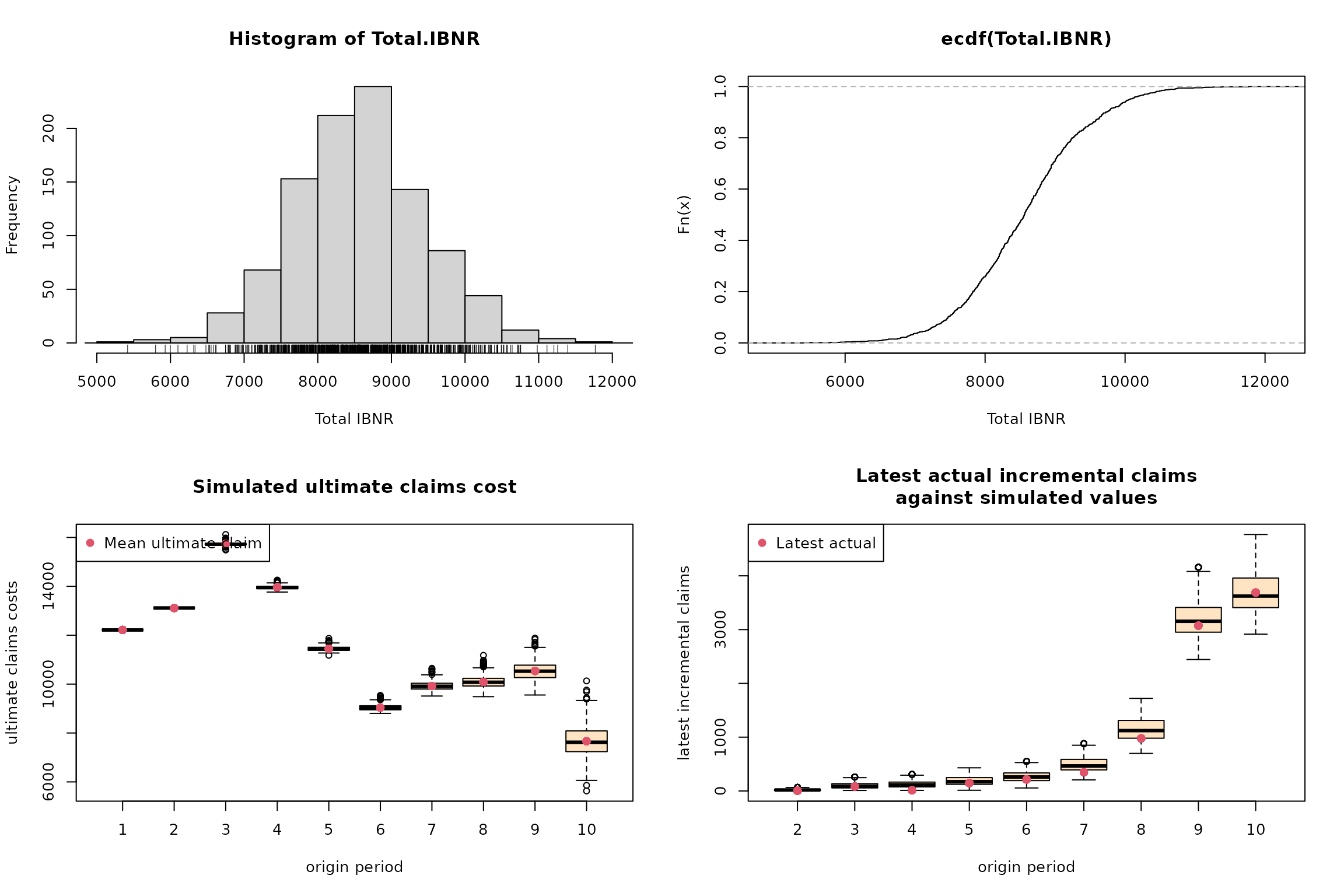

Thus, the overall distributional (reserve) prediction can be obtained from different perspective: adopting some distributional assumptions (such as the Poisson model), using the residual bootstrap approach, or performing the permutation bootstrap for whole functional profiles.

cameron.glm <- glmReserve(observed(cameron))

cameron.boot <- glmReserve(observed(cameron), mse.method = "bootstrap", nsim = 100)

cameron.permute <- permuteReserve(glmReserve(observed(cameron)), B = 100)All three summary() outputs below contains full

information (especially the last two columns denoted as S.E

and CV):

summary(cameron.glm)## Latest Dev.To.Date Ultimate IBNR S.E CV

## 2 13113 1.0000000 13113 0 0.01035287 Inf

## 3 15720 0.9992372 15732 12 29.38975320 2.4491461

## 4 13872 0.9934116 13964 92 73.46098788 0.7984890

## 5 11282 0.9850694 11453 171 96.26787355 0.5629700

## 6 8757 0.9688019 9039 282 120.58781735 0.4276164

## 7 9325 0.9397360 9923 598 177.57019068 0.2969401

## 8 8984 0.8905630 10088 1104 246.00693847 0.2228324

## 9 8202 0.7789914 10529 2327 379.54811405 0.1631062

## 10 3689 0.4788422 7704 4015 622.22022041 0.1549739

## total 92944 0.9152986 101545 8601 880.66723938 0.1023913

summary(cameron.boot)## Latest Dev.To.Date Ultimate IBNR S.E CV

## 2 13113 1.0000000 13113 0 0.00000 NaN

## 3 15720 0.9992372 15732 12 39.78803 3.31566877

## 4 13872 0.9934116 13964 92 69.63145 0.75686361

## 5 11282 0.9850694 11453 171 88.73998 0.51894727

## 6 8757 0.9688019 9039 282 108.17280 0.38359149

## 7 9325 0.9397360 9923 598 174.12157 0.29117319

## 8 8984 0.8905630 10088 1104 267.14475 0.24197894

## 9 8202 0.7789914 10529 2327 393.02842 0.16889919

## 10 3689 0.4788422 7704 4015 556.93632 0.13871390

## total 92944 0.9152986 101545 8601 841.41341 0.09782739

summary(cameron.permute)## GLM based reserve prediction (with B = 100 bootstrap permutations)

## First Latest Dev.To.Date Ultimate IBNR S.E CV

## 2 5984 13113 1.0000000 13113 0 0.000000 NaN

## 3 7452 15720 0.9992372 15732 12 3.087699 0.2573083

## 4 7115 13872 0.9934116 13964 92 14.070626 0.1529416

## 5 5753 11282 0.9850694 11453 171 35.269466 0.2062542

## 6 3937 8757 0.9688019 9039 282 89.645139 0.3178906

## 7 5127 9325 0.9397360 9923 598 140.511467 0.2349690

## 8 5046 8984 0.8905630 10088 1104 220.787040 0.1999883

## 9 5129 8202 0.7789174 10530 2328 544.173060 0.2337513

## 10 3689 3689 0.4789043 7703 4014 1225.273638 0.3052500

## total 49232 92944 0.9152986 101545 8601 1231.636024 0.1431968## Overall reserve distribution## Boot.Mean Std.Er. BootCov% BootVar.995

## 10916.062751 1231.636024 11.282786 1.232687

##

## The GLM predicted reserve represents the 4.95% quantile of the reserve distribution

## Bootstrap simulated reserves beyond 2σ rule: 1 (out of 100)

Note: The permuteReserve() function

returns a relatively complex R object of the S3 class

permutedReserve which can be quite memory demanding

(especially for large run-off triangles and large number of

permutations. For this reason, there is an additional parameter

outputAll = TRUE (set as TRUE by default) used

to suppress compex outputs and important summary characteristics are

printed only (for outputAll = FALSE).

6. Generic S3 method predict()

Finally, there is one key S3 method implemented in the

R package ProfileLadder that was not

mentioned yet—the S3 method predict(). This function is not

only useful for the actuaries, but it also has important practical

utilizations in any type of risk modeling. The S3 method

predict() is implemented for the objects of the S3 class

profileLadder that are created by the

parallelReserve() function or the mcReserve()

function (for details, we refer to the help session obtained by

help("predict.profileLadder").

Instead of completing the run-off triangle into a full square (as

performed by one of the algorithms PARALLAX, REACT, or MACRAME), the

predict() method only returns the prediction of the next

running diagonal (also called a 1-step-ahead prediction in the

acturial circles).

The same nonparametric algorithms are used for the diagonal prediction; however, the output is not a completed square but rather a new (extended) run-off triangle of the dimensions :

(diag.cameron <- predict(parallelReserve(cameron)))## 5244 9228 10823 11352 11791 12082 12120 12199 12215 12215 12215

## 5984 9939 11725 12346 12746 12909 13034 13109 13113 13113 .

## 7452 12421 14171 14752 15066 15354 15637 15720 15724 . .

## 7115 11117 12488 13274 13662 13859 13872 13947 . . .

## 5753 8969 9917 10697 11135 11282 11320 . . . .

## 3937 6524 7989 8543 8757 8904 . . . . .

## 5127 8212 8976 9325 9539 . . . . . .

## 5046 8006 8984 9333 . . . . . . .

## 5129 8202 8966 . . . . . . . .

## 3689 6276 . . . . . . . . . The S3 method plot() can be used to visualize the

diagonal 1-step-ahead prediction

plot(diag.cameron)

Conclussion

The main core of the R package

ProfileLadder consists of three key

functions—parallelReserve() for applying the PARALLAX or

REACT algorithm, mcReserve() implementing the MACRAME

algorithm, and permutedReserve() providing the permutation

bootstrap add-on. Another generic functions (for the S3 objects of the

class profileLadder, profilePredict,

mcSetup, and permutedReserve) are also

implemented to facilitate a well structured summary of the outputs and

graphical visualizations of the results.

There are also a few other helpful functions implemented in the

ProfileLadder package. For a complex description and

illustrative examples, we refer to the R help sessions

by using the standard help() command.

The ProfileLadder package is particularly developed to

implement nonparametric methods into the actuarial risk assessment

process performed by insurance companies (typically on a yearly or

quarterly basis). Nevertheless, the underlying run-off triangle can be

formally also represented in terms of an incomplete panel data scheme

that is generally well known among statisticians and all types of

practitioners.

Acknowledgement

The authors express sincere thanks to Kurt Hornik and Rob Hyndman for

their insight and some useful pieces of advice regarding the

ProfileLadder package. The authors are also grateful to

Petr Jedlička from the Czech Insurers’ Bureau and Pavel Koudelka from

Generali Česká pojišťovna a.s., for providing complex data from

real-life insurance practice—not only for internal evaluation purposes

but also for public access within the R package

ProfileLadder.